Innovation in banking and financial services enterprises is a challenging task. You need cost-effective, cutting-edge, and innovative solutions to increase profitability and improve customer satisfaction. That is where we make a difference—with our payments and cash management solution. We deliver high quality, innovative solutions engineered to suit your requirements. Our payments and cash management solution is designed to unlock more value with comprehensive features, high system performance, interfaces for connecting to clearing houses in different countries, and greater customer engagement

Taking Control

Banking and financial enterprises want innovative solutions and anticipation of customer needs through standardization, ERP integration, reconciliation, real-time reporting, and an end-to-end view of the payments and cash management value chain. They also seek the ability to reach a significant proportion of a lapsed customer base. The mounting pressure from competitors pushes them to look for solutions that can provide cost-optimized and value-added services to help and service their customers. Banks that provide cutting-edge cash management processes can offer innovative services and meet the expectations of corporate customers. They can perform intraday electronic payments globally, provide real-time visibility of transactions, and comply with existing and upcoming regulations for cross-border transfer of funds. As business transaction volumes and cost pressures increase due to heterogeneous IT infrastructure and disparate IT landscapes, financial institutions need to anticipate their customers’ needs and manage channels of collections, payments, and accounting information to increase revenue and profitability.

Our Solution

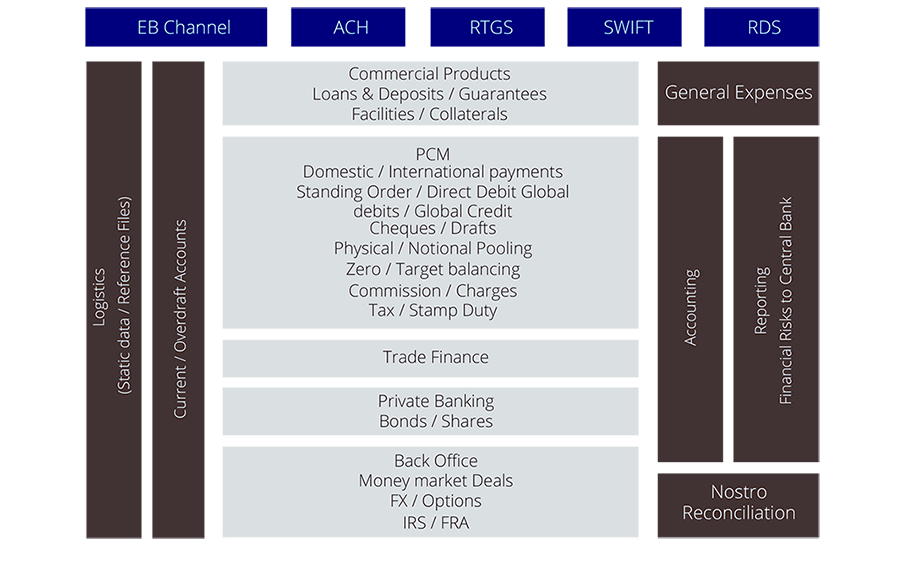

Our domain specialists have significant experience in designing and developing payments and cash management solutions for financial institutions. We have expertise in areas such as Real-time Gross Settlement Systems (RTGS), compliance to Target 2 and Single EURO Payments Area (SEPA), domestic cash management, and Nostro reconciliation.

Domain-Specific Solutions

Payments

- Processing

- Reconciliation

Clearing and Settlement

- Compliance with Automated Clearing Houses (ACHs)

- Routing to RTGS

- Continuous Link

- Settlement, Confirmation / Affirmation Services

Cash Management

- Cash Management Services

- Cash Pooling

Society for Worldwide InterBank Financial Telecommunications (SWIFT) / SEPA

- Impact Analysis

- Technical Implementation

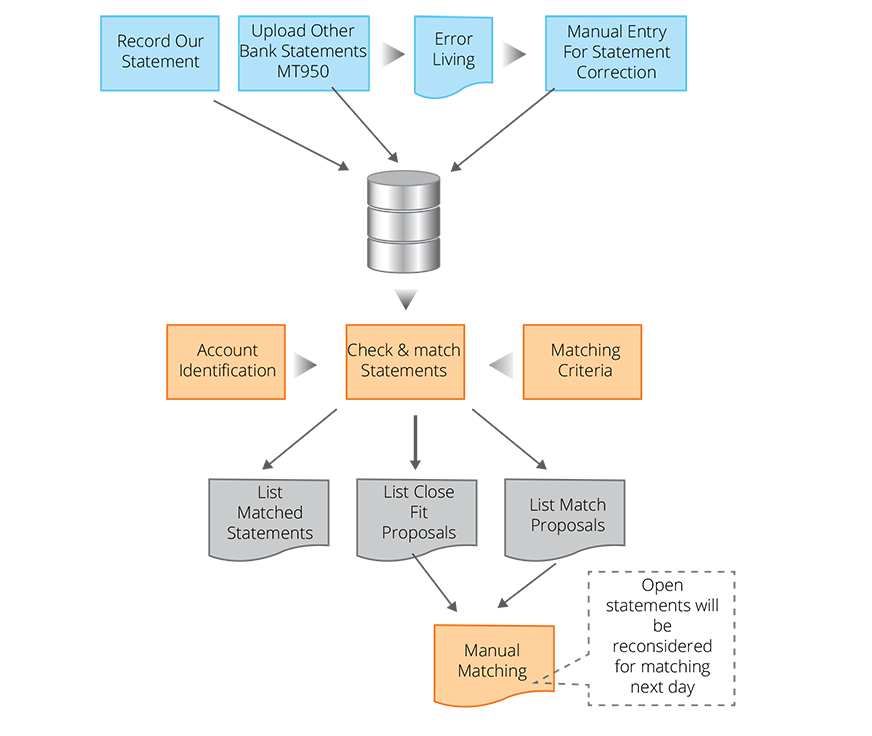

Success Story 1: Streamlined Reconciliation Processes for a Leading European Bank

We helped a leading European bank in streamlining its reconciliation processes. The bank partnered with us for reconciling their accounts by matching statements from other banks with their own mirror account statements. Our banking domain experts helped the bank in sending statements via email that were earlier done manually in the financial system.

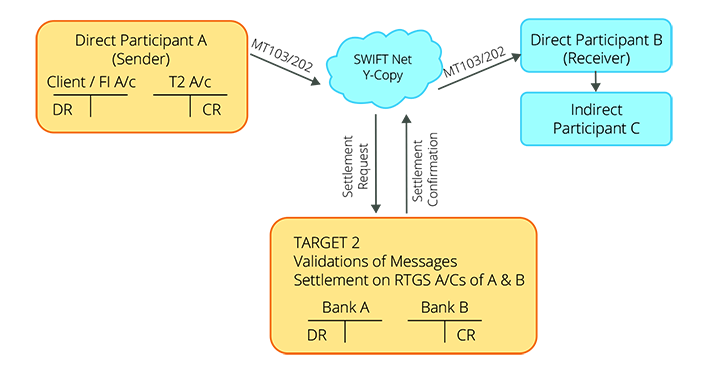

Success Story 2: Built a Centralized Real-time Gross Settlement System

We assisted the client in designing and developing centralized RTGS—Target 2—for urgent and high value payments in Euros. Our banking domain experts eliminated the need for a country-specific RTGS. The centralized system processed transactions under basic conditions, rights, and obligations across national boundaries. A reliable and safe mechanism was used for the settlement of payments on the system throughout Europe.

Success Story 3: Developed a Financial Management Strategy for a Leading European Bank

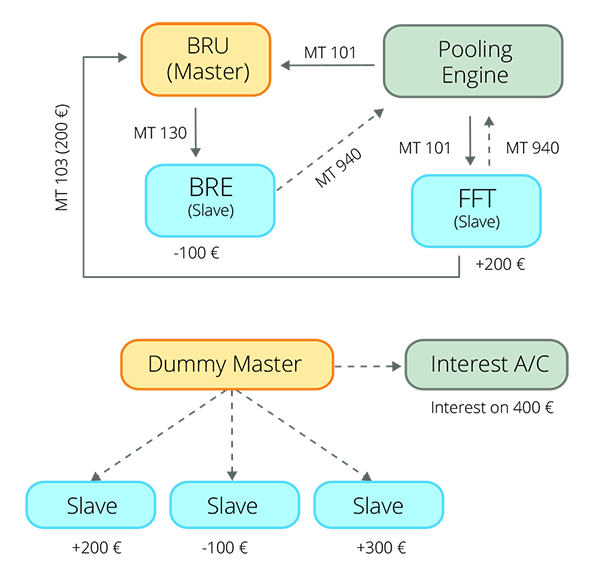

We implemented a cash management solution to optimize cash resources. The bank’s IT team wanted a physical cash pooling system and a notional cash pooling system. In the physical cash pooling system, we helped sweep account balances between slaves and master accounts for centralized control. The credit balances were also swept from slaves to master accounts. We eliminated overdrawn positions in the slave account by transferring funds from the master account. The participating account did not bear any credit or debit interest and all balances were concentrated in the master account.

In the notional cash pooling system, we summed the balances to calculate interest without transferring funds, calculated daily interest based on the net value balance of all pooled accounts, and defined the difference between normal interest and global interest after pooling. Global interest after pooling provided interest compensation to the company

Delivering More Value to Capital Markets Firms

- More Savings: The implementation of a fixed price dual-shore model helps us reduce cost per transaction, cost of maintenance, and total cost of ownership.

- More Satisfaction: We develop new interfaces for connecting clearing houses in different cities. We can free your resources to pursue your business strategic goals.

- More Improvements: We implement Target 2—an interbank payment system—for improvements in your business performances. We improve customer engagement through our maturity model.

- More Efficiency: We create Straight-through Processing (STP) frameworks to achieve efficiency.

The Coforge Advantage

Our extensive domain understanding makes us the ideal partner for your payment and cash management needs. We provide focused and dedicated services such as application development, support and maintenance, legacy modernization and migration, testing, and implementation of industry-focused solutions across a wide range of technologies to increase your time-to-market. Most importantly, our global Web presence, a wide pool of talented resources, and our endeavor to build long-term relationships have enabled us to deliver high-quality cost-effective solutions engineered to suit every client’s requirements.

We add value to the engagement by re-engineering clients’ business processes and allowing them to focus on their core competencies.