Processes should be designed to help banks surge ahead, not limit their competitiveness. Yet, most banks find that their business processes have cast a rigid mold, impeding the implementation of critical strategies that will drive their next wave of growth. The need of the hour for banks is agility, which can be realized through the Coforge’ Streamline process automation framework. Designed to simplify processes and unlock greater business execution and performance, Streamline delivers with automation, system integration, and standardization. The outcomes that Streamline helps orchestrate are game-changing-like 100 branches transformed in just four months, and a 75% reduction in customer servicing time.

Roadblocks on the Path to Transformation

The dynamic nature of today’s IT landscape places immense pressure on banking institutions to transform by modernizing their legacy systems, driving greater process agility, and adopting revenue-enabling solutions. While banks recognize that transformation is imperative, they must first overcome the complexity of their current operating normal, which is characterized by many challenges:

- No enterprise view of processes

- Non-standardized processes and inputs

- Unstructured data

- Unorganized and skewed

- Reduced turnaround time for customer service

- Manual processes and intervention

- Changes in core systems require more resources, time, and cost

- Limited or no option to review and measure resource utilization

- Paper-based and manual processes

Shape a New Operating Normal with Streamline

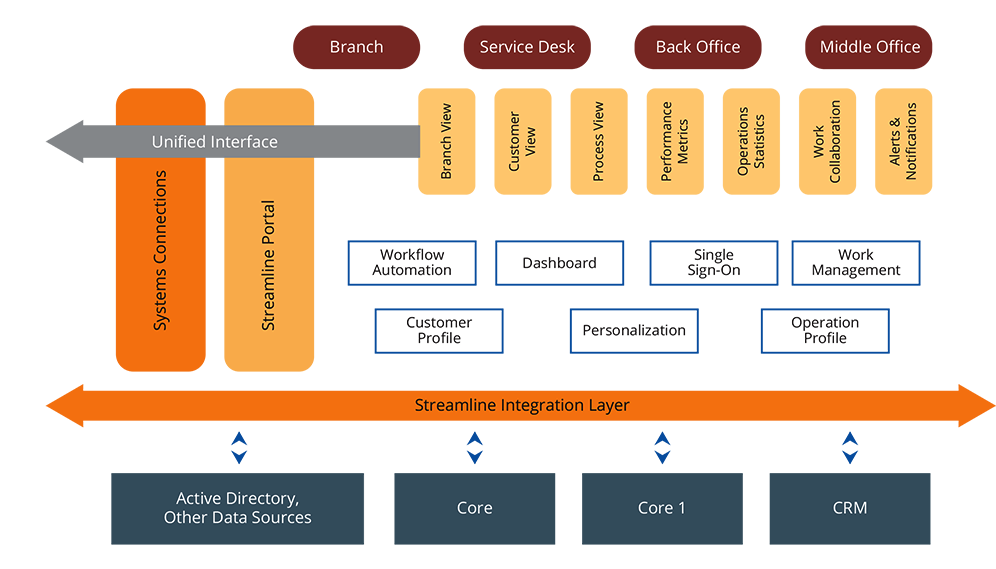

Our Streamline process automation framework is a simplified and comprehensive operational transformation solution that reduces cost, improves customer service, and enhances operations.

All banks need to do is verify their IT requirements and the solution can be mapped and customized accordingly, within a short time frame. CIOs do not have to worry about traditional business requirement gathering and analysis process, which is a tedious task in itself. The solution brings in a pre-defined, industry-specific framework that can be easily adapted into the banking ecosystem.

The framework enables transformation of fundamental front-, mid-, and back-office processes. It seamlessly integrates with core banking systems without the need to rip and replace current operational systems.

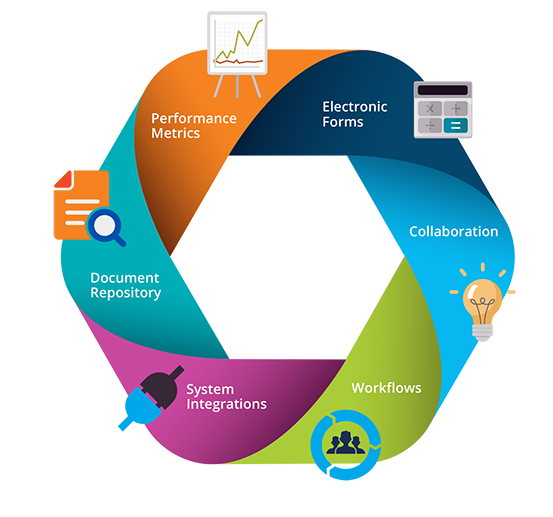

Process Automation Framework at a Glance

Key Features

- Optimizes resource utilization

- Offers fewer manual touchpoints

- Provides unified paperless processes

- Provides online environment for distributed access

- Adjusts rapidly to increased compliance and evolving market

- All control improvements are the same as process improvements

- Ensures cost- and time-effective change management, without any core upgrades

- Ensures transformation within a limited time frame due to high implementation speed

- Provides monitoring, measurement, and deployment of staffing changes based on data set

We provide a fully outsourced and variable cost utility service that helps streamline processes and provides means to consolidate forms in the areas of customer service, credit, human resources, and back-room operations. Process transformation services backed by the deep industry experience of our practitioners are enhanced by our integrated set of industry-leading program management solutions along with design processes and tools.

Delivering More Value

We support execution of business transformation with an approach that is process-oriented, not person-specific. This drives better quality and faster reaction times. Streamline has helped various clients realize rapid business value, greater scale, and higher efficiency:

- Transformed 100 branches for a client within four months

- Reduced customer servicing time by 75%

- Processed 2,500 requests in a month

- Reduced requirement analysis efforts by 50%

- Enabled rapid change management, reducing the time frame by 18%

By leveraging Streamline, enterprises can achieve:

- More Cost-Effectiveness: Improved processes and controls leading to cost-effectiveness

- More Flexibility: Streamline is agnostic of the core solution provider

- More Automation: Paperless processes reduced human error and communication

- More Efficiency: Streamline improved resource utilization

- More Agility: Rapid adjustments increased compliance and evolving markets