Customer expectations of a fast, seamless, friction-free buying and service experience are as high in the banking and finance sector as they are in any other. But in this tightly regulated and competitive space, your personalized service standards have to exceed expectations daily.

Coforge has three decades of experience helping banking and finance organizations address the challenges of the connected customer, escalating legislation, disruptive technology, complex processes, and the rise of new, agile, digital-born competitors. We’ll help you accelerate your growth ambitions through an ecosystem of innovation, personalization, efficiency and value.

Unique solutions to your unique challenges

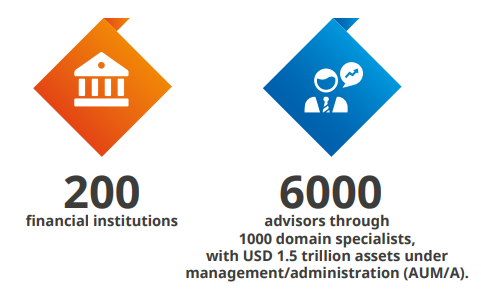

Three decades of experience and deep domain expertise working with over 200 financial institutions and 1000 sector specialists puts Coforge in a unique position. It means we are able to gain a rapid understanding of your business and the issues you face, and help you effectively address your specific challenges through technology.

Here’s how we help drive transformation and growth across both Retail and Corporate Banking, and Asset and Wealth Management.

Retail and corporate banking

Banks that offer innovative, hyper-personalized services can meet elevated expectations and delight corporate and private customers alike.

Get real-time visibility of your customers and processes, perform more and faster transactions globally, comply effortlessly with new legislation, integrate and maximise value from both new and legacy technology systems, and respond instantly to changing customer or business needs. Better still, anticipate them!

Asset and wealth management

In an increasingly complex marketplace, Coforge supports over 200 financial institutions and 6000 financial advisors with managed platform and hyper-specialized services services. We help the asset and wealth management sector deliver best-in-class digital experiences faster, at every stage of the customer lifecycle.

Intelligent client on boarding

Improve advisor productivity while increasing value for the customer.

Zero touch experiences

Empower advisors with digital tools and solutions to streamline front, middle and back office functionalities for a better investor experience

Advanced analytics

Deliver financial advice aligned to your customers’ personal financial goals, with deep data-driven insights

Improved digital experience

Simplifying touch points and creating intuitive and emotionally empathetic user experiences for customers.

Intelligent automation

Execute business processes and operations with a greater efficiency, minimum workforce, fewer human errors and reduced cost.

Coforge: Disruptor in Banking and Financial Services

The changing Banking & Financial Services world calls for innovation partners who understand your business, provide customized solutions, and leverage new technologies and methodologies for the benefit of your business and its customers.

With 30 years of experience delivering up-to-the-minute, robust solutions, platforms and applications, we’re at the heart of innovation and value. We are the trusted technology partner working with over 200 financial institutions.

We’re not only renowned for our expertise, but for our highly personal approach. Every customer is different and every challenge is unique, but we apply the same rigour to every partnership and every project.

Together we’ll help you leverage emerging technologies to create a smarter, more agile, thriving business that delivers exceptional experiences, and innovative new revenue opportunities, seamlessly and profitably.

Our offering.Your solution.

Below are some of the specialist services and state-of-art solutions through which Coforge helps you deliver next-generation personalized experiences and drive business growth. Engage with the emerging and deliver innovation, differentiation, automation, and exceptional customer experiences and value. Engage with Coforge.

Digital Transformation

With superior customer experience as the cornerstone of strategy, our digital services include:

- Digital Integration

- UX

- Digital Process Transformation

- Blockchain

- Cognitive technologies

Case study: Large asset management client Implemented Alexa powered chatbots and an award-winning digital portal for an increase in investable assets.

Data and Analytics

Using cross-industry expertise and best fit tools, our services cover the entire data landscape:

- Leveraging enterprise and external data sources

- Visualization technologies

- Advanced analytics

- Data management

- Data Governance

Case study: Tier 1 European bank

Enabled holistic wealth management through data insights via integrated architectures, automated interactive dashboards and persona driven analytical insights.

Cloud Services

Powered by buy-side industry insights, dominant capability, and native automation platform, we’ll help you maximize the cloud environment with:

- Migration services

- Operation services

- Management services

- Security

Case study : Complete compliance for co-operative banks

19 Indian co-operative banks were migrated to Azure on BankingEasy core banking platform, enabling effortless compliance with local regulations.

Intelligent Automation

Expertly delivering automation at scale with Tron, our AI-led Intelligent Automation Platform. Services include:

- Robotic Process Automation

- Business Process Management

- IT Ops automation

- Cognitive services

Case study : Large asset management client

Implemented Robotic Process Automation and achieved 40% cost reduction, managing the pressure on profitability.

About Coforge

Coforge is a leading global IT solutions organization, enabling its clients to achieve real world business impact through unparalleled domain expertise working at the intersection of emerging technologies. The company focuses on three key verticals: Banking and Financial Services, Insurance, Travel and Transportation. This domain strength combined with leading-edge capabilities in Data & Analytics, Automation, Cloud, and Digital, helps clients innovate business, automate process and industrialize AI.