Digitally disruptive, globally trusted, operationally fortified–if these are the mandates, we are ready to deliver. At Coforge, we have the expertise, insight, and outlook to help you compete better today and build a flexible IT environment that is ready for tomorrow’s opportunities. With new ideas, innovative solutions, and reliable services, we are committed to unlocking more value across your financial value chain, from customer interaction to process automation to digital transformation.

Answer Disruption with Transformation

With the global economy amidst a volatile phase, financial services institutions and capital markets firms are challenged on many fronts, all of them to some degree intertwined, and all of them critical to restoring sustainable growth. Financial institutions are in a period of strategic transformation, and must attend to a wide range of issues simultaneously—some more visible and fast-moving, others more fundamental and longterm.

To compete, financial services firms need to reposition themselves for higher performance and new growth opportunities. Among the more prudent steps you can take is to transform your IT foundation to become more adaptive to customer needs. Meeting the changing demands of customers is a constant challenge—seamless service across channels, and packaged, and customized financial products. Simultaneously, your organization must concentrate on managing risks, cutting back costs, and executing business in a more stringent regulatory environment. The competitive landscape is evolving with a large number of non-traditional players eating into your market share.

Agility is Your Competitive Edge

To increase profits while grappling with disruption, it is imperative to move swiftly and efficiently in order to seize opportunities. But to do so, your underlying technology solutions and business processes must be geared for agility. Having managed complex systems and multi-dimensional technology environments for over 200 financial institutions, we know what it takes to deliver agility-integrated frameworks to adopt new technologies faster, the flexibility to scale based on changing needs, and a relentless commitment to create new efficiencies.

Highlights: The Coforge Banking and Financial Services Practice

Retail Banking | Wholesale Banking | Investment Management | Application Development Management | Managed Services | Cloud Computing | BPO

- Servicing over 200 Financial institutions

- 10 of the top 15 US private banks

- Over 100 asset managers

- 15 wealth management firms

- 6 broker dealers

- 30 pension funds

- Over 15 years of Proven Experience in Servicing Capital Markets Firms

- Asset Under Management (AUM) supported: US$ 1.5 trillion+

- Financial advisors supported: 6,000+

- End customer supported: 1.5 million+

- Over 8,000 Person Years of Solution Delivery Experience

- 45+ software products supported

- 350+ releases per year

- Specialist in Wealth and Investment Management Technologies

- Served the industry for over 20 years through our strategic association with SEI – Deep understanding of end-to-end financial value chain

- Recognized for Excellence

- Best Outsourcing Award from a leading European bank

- ICT Innovation Award for a Belgian financial institution

Leverage Our Expertise: From Legacy Modernization to Operational Transformation

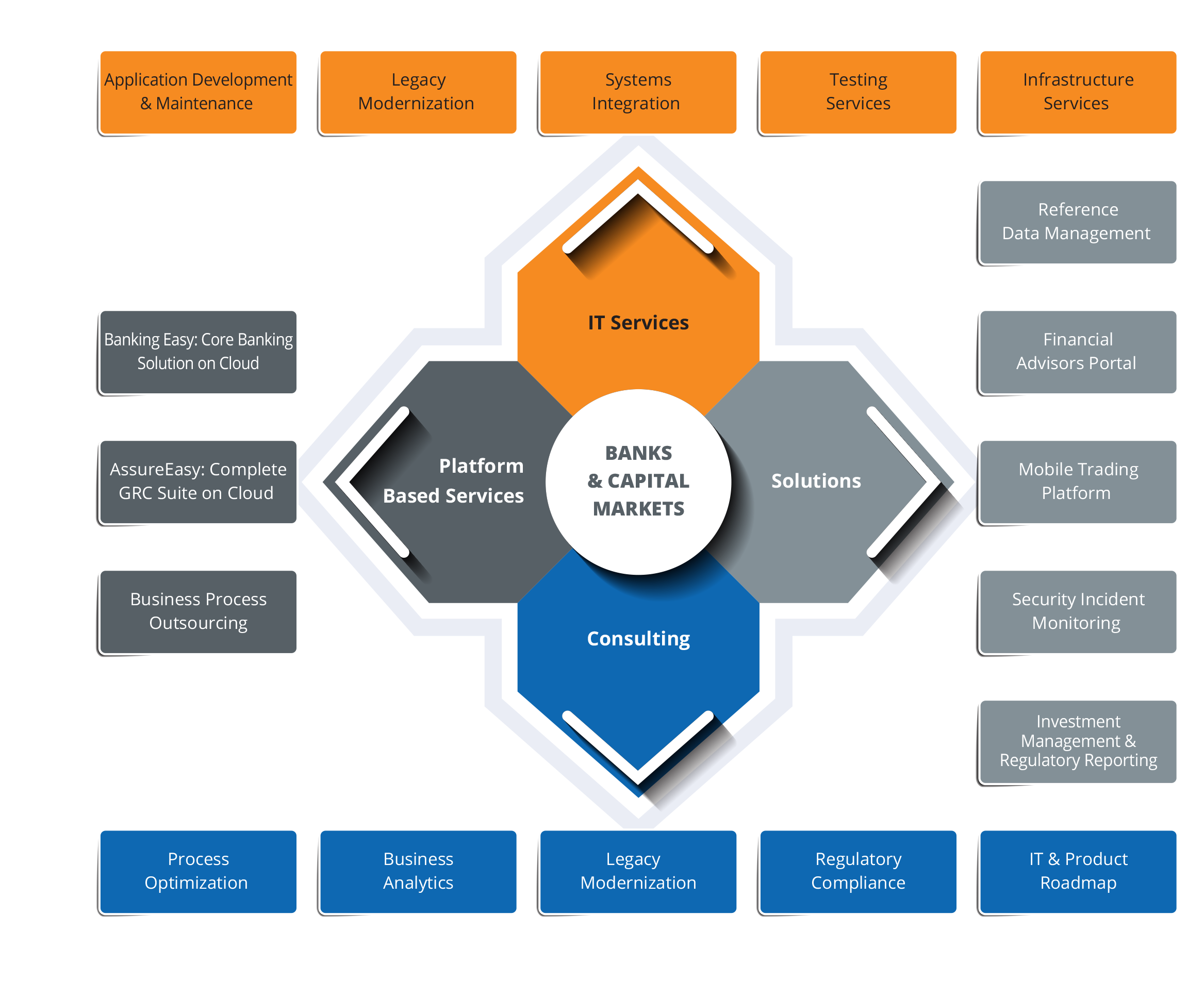

Coforge offers financial enterprises a wide range of offerings to stay on top of risk, comply with regulations, and manage transformational challenges, while increasing efficiency, improving service levels, and driving the adoption of new technologies.

Functional Expertise Our expertise spans operations consulting, business process outsourcing and management, as well as infrastructure and application management.

Service Offerings

The banking and financial services framework at Coforge encompasses a comprehensive multi-dimensional matrix.

Our Functional Expertise

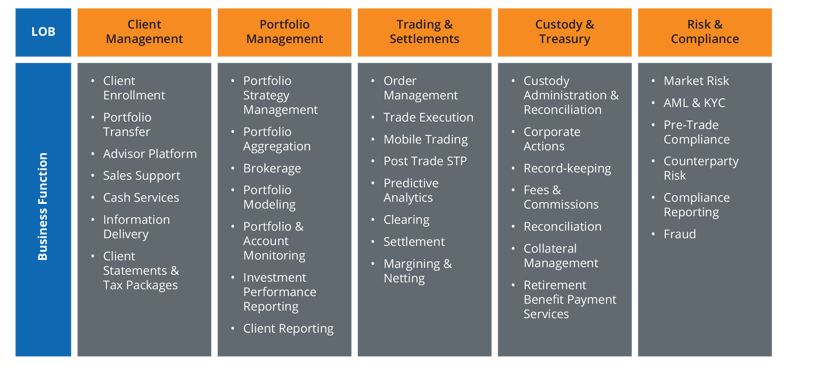

- Asset Management and Securities: Order and trade management, risk management, mutual funds, hedge fund portfolio accounting, trust accounting, retirement benefits, portfolio performance and attribution, custody, corporate actions, compliance (AML and post-trade).

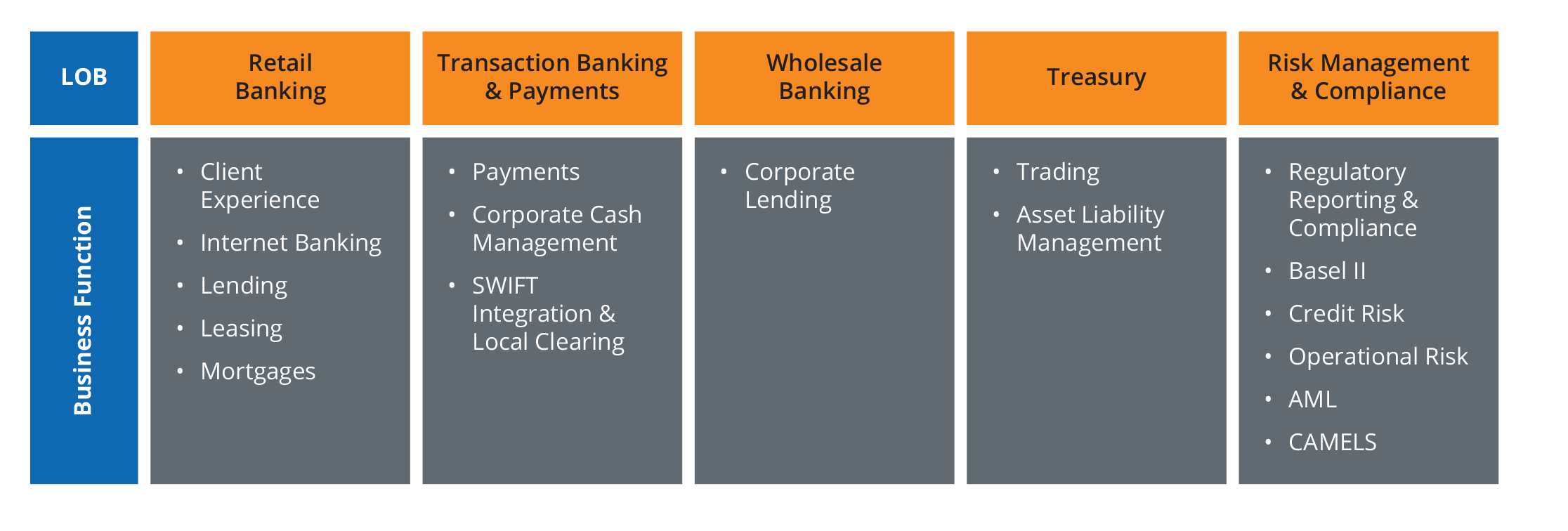

- Banking: Client experience, Internet banking, lending, leasing , mortgages, payments, corporate cash management, SWIFT integration and local clearing, trading, asset / liability management.

Comprehensive Experience in Servicing the Capital Markets Value Chain

We are working with clients in varied service lines to create best-in-class efficiencies.

Experience across Platforms

From front-office to back-end, we can make your systems more adaptive

Front-Office

- Order Management System (OMS) – Treasury Point, Charles River, Longview, Calypso and Misys

- CRM – SalesForce

Mid-Office

- Reconciliation – Advent

- Cash Management – Smartstream Transaction Lifecycle Management

Back-Office

- Wealth Management – Global Wealth Platform

- Compliance – Actimize (AML), Protogent (Trading)

- Reference Data Management (ADS)

- Investment Accounting – TRUST 3000R

- Data Aggregators – Pershing, Albridge

Extensive Experience in Providing Solutions to Retail and Corporate Banks

We have deep expertise in business processes, technology architecture, and products to address the needs of banking enterprises.

Select Platform Experience

- Misys – Equation, MiDAS

- DataMate

- Fermat ALM – Risk management and application lifecycle management

- Actimize – AML

- LexisNexis – KYC / Watch Lists

- Wall Street systems

- Electronic Bill Payment & Presentment (EBPP), Automated Clearing House (ACH)and local wire integration and application for financial institutions

Maximize Returns from Your Digital Transformation Initiatives

To accelerate your digital journey, we deliver rapid integration of digital and legacy assets with custom tools and expertise from Incessant, our digital and BPM arm. With us, you can keep pace with the changing data. We provide solutionso and frameworks for seamless aggregation of structured and semi-structured data into analyzable and reportable formats.

Our Digital Foresight solution is designed to help you go from information to action faster. It delivers actionable business outcome-focused analytical insights by combining voluminous and varied internal and external data sources.

Solutions and Frameworks

Our diverse technology and business process management strengths give us the ability to develop, own and manage your most complex systems and operations.

Industry-Specific Solutions

- Reference data management solution

- Advisor portal solution

- Security incident monitoring

- Mobility

- Regulatory and investment management reporting

- Core banking

- AssureEasy—to manage compliance, technology and operational risk

Testing Framework Capabilities

- Structured banking testing framework

- Dedicated testing center of excellence

- Development of in-house business testing frameworks covering:

- Internet and mobile banking

- Lending and mortgages

- Wholesale and retail payments

- Retail and corporate deposits

- Order management for securities

End-to-End Enterprise Solutions

- Application development and maintenance

- Application renewal: migration, modernization and decommissioning

- Testing services

- Data warehousing and business intelligence

- Enterprise solutions: package implementation and managed services

- Business process management services: customer support, finance and accounting, transactional support, sales and marketing

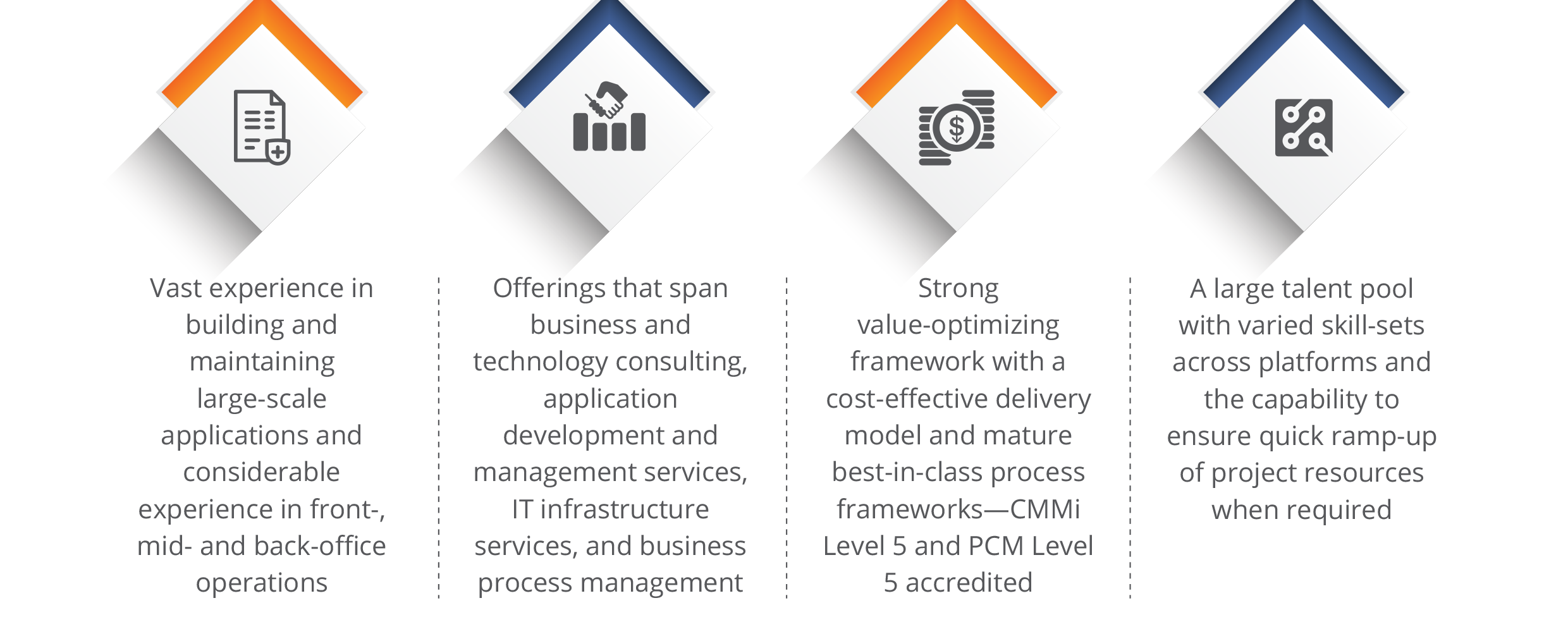

More Value at the Heart of Partnerships

With relevant experience, deep domain and technology expertise, and the ability to scale to changing demands, we are here to stay the transformation course with you.

At Coforge, we are committed to working closely with you to keep your enterprise on the leading edge of change—whether it is managing compliance better, modernizing your systems to compete stronger, or mobile-enabling your customer service channels. When you partner with us, you get end-to-end capabilities that you can leverage to plan, implement and sustain your technology landscape while unlocking the agility to respond to new challenges and opportunities. As a trusted partner, our focus is to equip you with the solutions you need to not just achieve efficiency gains, but also to take a strategic leap forward.