Abstract

Improving the efficiency of your insurance business and driving new growth may not be hard to achieve with a robust legacy modernization solution. From planning to conversion and finally decommissioning, our legacy modernization solutions re-engineer business processes and deliver more value by enhancing business agility, improving operational efficiency, reducing costs, and improving margins.

Dealing with Legacy Dilemma? Switch to Legacy Modernization Solutions

Legacy modernization is one of the top priorities for insurance carriers to reduce operational costs and improve time-to-market. Insurers are in search of solutions that can relieve the pain of deciding whether to replace, modernize, or consolidate legacy systems. Replacing them can result in loss of company’s collective wisdom, capital, and business value. However, modernizing and consolidating legacy systems helps insurers focus on harnessing this wealth of information while providing business agility and operational efficiencies.

Most insurers today are looking for strategic long-term partners who can provide dedicated professional services and support to guide them through the entire package implementation lifecycle and take ownership of associated risks.

Our legacy solution is geared to offer you business agility, reduced time-to-market, and optimal operating costs. We have over 15 years of experience in providing a range of technology services to Fortune 1000 insurance services providers. Today, we are at the heart of their transformations—providing end-to-end strategic consulting for modernizing legacy systems.

To Leverage Existing Wealth of Information, Modernize First

To expand to new markets, insurers need to grow. Numerous mergers and acquisitions result in an IT landscape with unsupported platforms, which necessitates retaining a workforce with the relevant legacy skill set. These factors add to maintenance overheads and reduce insurers’ agility in responding to market dynamics. Insurers therefore realize the need to modernize their legacy PAS to:

Key Features

- Improve time-to-market: Due to a competitive environment, insurers have to sustain their market position by introducing new products faster to the market. Legacy systems make it difficult to offer new products faster due to their complex nature

- Contain operating costs: Many legacy environments are expensive in terms of both hardware and software.

- Ensure regulatory compliance: All administration systems must comply with regulations and rules. There is a high cost involved in making them compliant.

- Integrate with new technologies for better user experience: In today’s world of digitalization, it is important to integrate administration systems with newer technologies. Legacy systems can limit insurers’ need to adapt to newer technologies and hence limit business growth.

- Allows user to make data transformations

Solution

Coforge collaboratively works with clients to create legacy transformation solutions, and tools and accelerators around the implementation challenges. Our key differentiators include:

- Robust and proven legacy modernization framework

- Unique and innovative methodology for data migration

- In-house tools and utilities to facilitate data migration, testing, interface remediation, and development

- Proven migration estimation model

- Automation tools for validation of conversion/migration accuracy

- End-to-end support and maintenance of new target system

- Re-skilling of resources using proprietary knowledge management tool

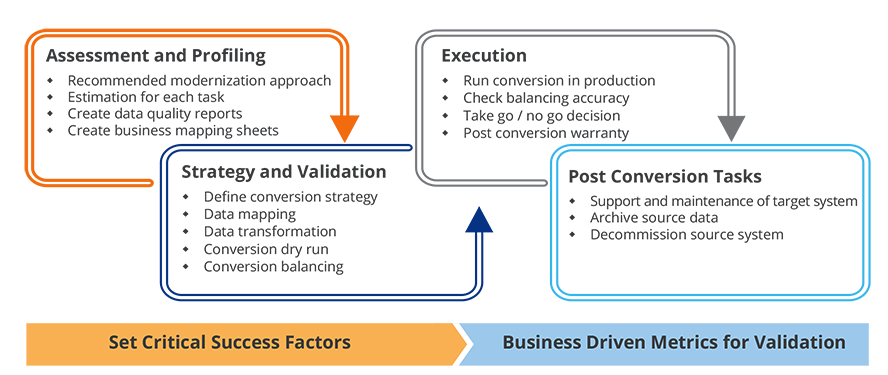

Our Approach

Coforge follows a comprehensive end-to-end approach for legacy system modernization:

- Assessment: There are multiple ways to modernize legacy systems. However, we help organizations choose the right approach based on legacy system complexity as well as critical business applications interfacing with administration systems. At this stage, we deliver a recommended modernization approach along with the associated risks, and the total estimated costs and effort required. Our proven estimation model for conversions helps determine the effort required with high precision. This estimation model caters to all Lines of Business and takes key business parameters as inputs to give accurate results.

- Source and Target System Profiling: Once the approach is finalized, the focus is to get more details on source and target systems—identifying key fields, and creating data quality reports and inputs for mapping and testing. We deliver business rules mapping at this stage. Decision on historical data is also taken after data profiling.

- Conversion Strategy: At this stage, the conversion strategy is defined—file-to-file, data-driven or cycle up, or transaction-driven. A decision is also taken whether the conversion will be point in time (partial history) or inception to date (complete history).

- Validation: Based on the ‘Test Early or Test Often’ principle, automated conversion testing tools are used to help in balancing the accuracy of financial fields as well as correct mapping of non-financial fields.

- Execution: At this stage, we run automated conversion flow to ensure accuracy of conversion. With robust automated testing tools and innovative conversion methodologies, Coforge has been able to maintain 99.9% conversion accuracy for all the conversion projects.

- Support and Maintenance: Once the conversion is complete, we support and maintain the new system including version updates, new product additions, custom modifications, and enhancements. Our Competency Development Framework and proprietary knowledge management tool help in creating talent on any platform under the guidance and mentorship of subject matter experts.

- Decommission: Once the source system has been migrated to the target system, it is important to decommission the old system. We offer automated impact analysis tools to decommission any kind of legacy languages in a short span of time.

Figure: Coforge Approach

Success Story 1: Developed a Modern, Web-based Platform for a Property & Casualty Insurer

A US-based Property & Casualty insurer engaged with Coforge for conversion of existing legacy PAS processes to Duck Creek technology applications. The consolidation of the client’s business on the new Web-based underwriting and policy administration platform saved the client approximately US$25 million annually.

Success Story 2: Consolidated Multiple Diverse Platforms on a Single PAS

Coforge worked with a Fortune 500 insurance company to consolidate multiple administration systems on a single PAS. We were involved from the inception stage and developed a transition strategy to perform legacy consolidation. Eight conversions were done from multiple systems (Legacy/Non-Legacy)—converting millions of policies for the target system.

Delivering More Value

Our proven expertise and capabilities in legacy modernization are validated by the trust that various insurance companies have placed in us for their solution requirements. By leveraging our legacy modernization solutions, we help clients realize the following tangible benefits:

- Conversion-oriented tools and estimation model for identifying and measuring success

- Conversion strategy designed to leverage target business functionality rather than simply converting source data

- Reusable methodology for future conversions

- Automated tool set for future conversions and conversion of historical data

- Test early, test often/future-proof testing approach

- Service layer and trigger generation concepts intrinsic to our transformation solutions

- Competency development framework and proprietary knowledge management tools to create talent on any platform

- End-to-end metrics-driven support and maintenance for new target system

The Coforge Advantage

Successful transformation can help reduce operating costs, ensure continuity, and enhance user experience. However, no single solution would fit the bill for all insurers and identifying the correct modernization solution is very important.

At Coforge, we are committed to understanding your business inside out, and helping you select the best conversion strategy to suit your needs. Count on our deep domain expertise, technology capabilities, and proven processes to modernize IT for better business performance.