Detect loan default and act on it in time or lose billions of dollars! Banks and financial institutions are at such a crossroad today and losing billions of dollars every year to credit default. Coforge’ Digital Foresight Financial Intelligence solution can help them see, foretell, and act on the information in time. The solution provides lenders a clear path that helps them identify, locate, and analyze characteristics of emerging credit default.

Challenges

Loss of billions of dollars and capital is due to loan default that emerges rapidly and goes undetected by the lender. However, these rapidly emerging default circumstances are highly discernable. Organizations can easily see, foretell, and act upon the default in time at the individual credit level with the help of Digital Foresight.

Events in the day-to-day life of an individual or a business can materially affect their ability to fulfill financial obligations on time, or not at all. It’s a big blow for financial institutions if they are not able to forecast emerging defaulters in time.

The impact on the financial institutions for not forecasting emerging defaults in time is grave:

- Loans are classified; squeezing capital and eroding income

- Internal costs skyrocket as non-performing loans lead to higher investments in people, time, and resources to manage bad credits

- Unwanted, expensive, and paralyzing attention from regulators and their questions about internal loan practices, financial reporting consistency, and overall financial solvency reigns

- Financial reporting accuracy is a critical risk due to the rapidly eroding credits, resulting in loss of reserves and write-offs (also affecting the credibility of the CEO, CFO, Chief Credit Officer, and Chief Compliance Officer). In fact, personal exposure to these problems also affects the Board of Directors

- Disastrous blowback in the borrower/lender marketplace is faced by the bankers’ insurer (for your D&O and other lines), rating agencies and, if publicly traded, capital markets

Our Solution

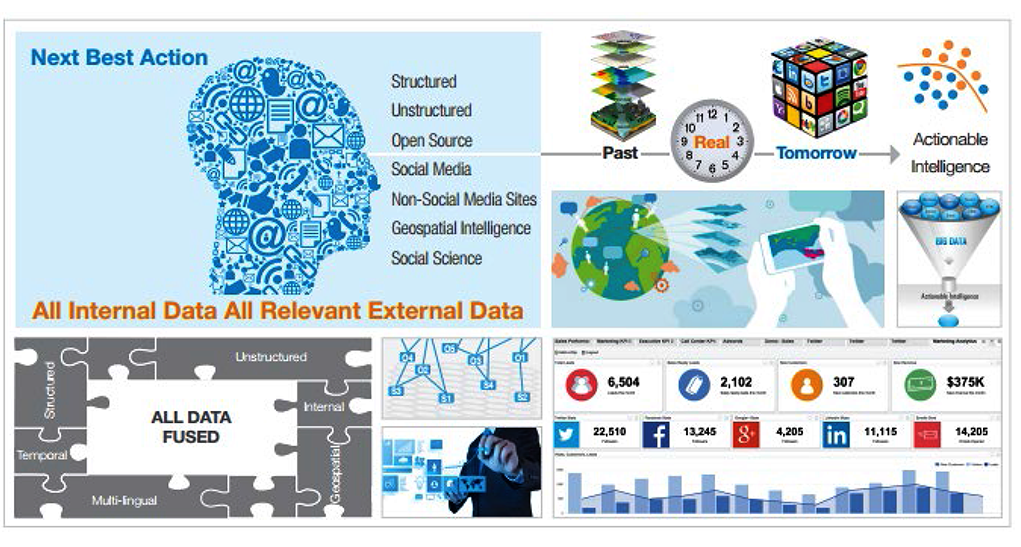

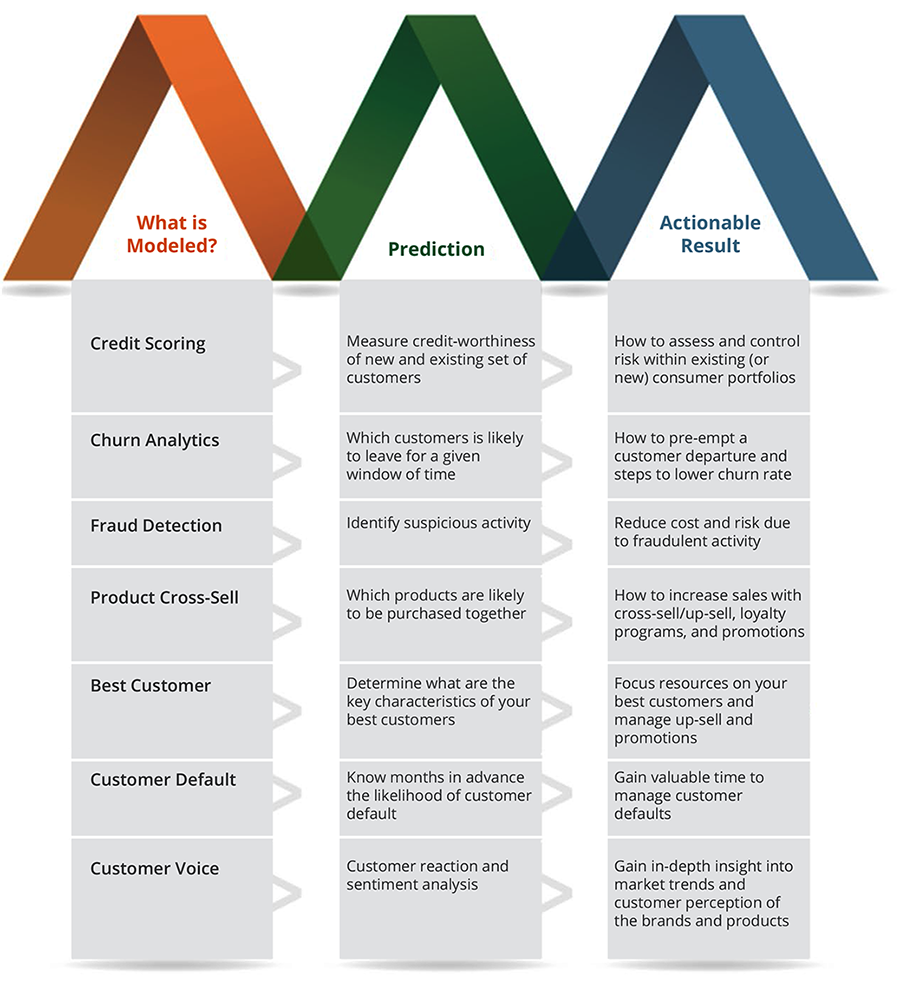

Coforge’ Digital Foresight Financial Intelligence solution helps lenders in reducing risks. It is not a static reporting mechanism but a solution that tags, tracks, and reports in real time the rapidly emerging credit risk to the financial institution, at the individual credit level. It provides Business Intelligence as a Service to financial institutions, with the capability to attain customer knowledge and assess the likelihood of default.

The solution carries out real-time harvesting and assimilation of relevant credit risk event data, information, and intelligence. It has the ability to disseminate that intelligence with clarity to the lender for timely action. The core components of the solution include:

- Geospatial intelligence harvests relevant credit-related emerging risk data and fuses it with internal data to develop forward-leaning predictive statistical analysis. It helps in defining actions that the lender should take for improved outcomes.

- Graph database construct ingests internal and external data, information, and intelligence as an essential tool to discover and capture complex interdependencies and data relationships to illuminate the rapidly emerging risk events tied to credit. Predictive context is used for actionable decisions to meet and solve the overall risk situation.

- Open domain information collection, assessment, and dissemination feature provides core understanding of rapidly emerging risk events at an individual credit level. The core enablers in this aspect include social media and non-social media.

- Social Network Analysis (SNA) enables lender clients to identify close-knit structures within small communities and congregations, and identify key sub-groups and families. SNA forms important bridges for learning re-payment attitudes and behavior that directly or indirectly influences the borrowers. It also characterizes borrowers’ interests and their critical needs to yield understanding on the initial or on-going credit-worthiness and the likelihood to default.

- Behavioral analysis is carried out with credit default predictive models and shows attributes of environment, past habits, events, and experiences from open domain information sources. It synthesizes with internal data to provide understanding of the likely course, action, and openness of a borrower.

- Monitoring and metrics offers insights and ways to constantly refine models that generate indications and warnings to the lender on credits in the portfolio.

The high likelihood of credit default is presented in the form of indications and warnings. You can easily discern rapidly emerging default with the help of our highly experienced financial experts from various intelligence and national law enforcement communities. Our overarching methodology consists of a two-level target strategy—macro and micro analysis. Top-level macro analysis applies geospatial intelligence techniques to determine the highest value market areas. The second level moves from macro to micro analysis and focuses on understanding individual credits (individuals, small to middle market commercial businesses, business owners of commercial risks).

Vast amounts of information are collected by taking data, information, and intelligence found in an equally vast Web of social networks and open domain resources. The information collected is then used to determine credit default that further predicts borrowers’ values and behavior. Digital Foresight examines borrowers’ pattern-of-life events—business contraction, business growth, marriage, divorce, legal woes, and so on. In each instance, the second-level of analysis finds, assesses, and quantifies the cause and effect of patterns of life (harvested through open domains) and defines how these events can influence the continuation of credit-worthiness and compliance. The observations are accordingly quantified and modeled, unfolding the need to understand the ever-changing and sharpening of new events in the life of the credit. It also drives home actionable understanding for the banker and the need to interdict emerging risk by restructuring the loan, selling the paper, and taking an orderly and managed write down.

Delivering More Value

By fusing internal customer data with external data (government bureaus, newsfeeds, financial reporting, public records, etc.), Digital Foresight can identify with high confidence borrowers who are likely to default in the near future.

- More Savings: Our Digital Foresight Financial Intelligence solution can reduce large upfront investments on infrastructure or software.

- More Satisfaction: Our solution helps lenders reduce the number of non-performing assets. It provides sufficient lead time to clients to work out a solution with customers likely to default (individuals or small businesses).

- More Opportunities: Lenders can provide other financial services to their customers—identifying what default risk can bring to the obverse.

The Coforge Advantage

Coforge is a leading IT solutions organization, servicing clients in North America, Europe, Asia, and Australia. We have been serving the banking and financial services industry for more than 15 years and support more than $1.5 trillion Assets under Management (AUM), more than 6000 financial advisors, and service more than 1.5 million end customers. With our service vision to deliver “New Ideas More Value,” we aim at providing service excellence to our clients through our capability and expertise in this domain:

- Leveraging our industry expertise in front-, mid-, and back-office business processes, we deliver on customer expectations

- Our digital capabilities encompasses strategic alliances, services, and solutions.

- As a right-sized partner, we offer integrated services capability spanning technology, digital, automation, infrastructure, operations, and product engineering.

- With experience in implementing real, pragmatic, and cutting-edge solutions for leading clients globally, we have the ability to demonstrate quantifiable ROI.

- Our highly experienced Digital Foresight delivery team has hands-on experience of working with leading financial institutions from credit to collection, SIU, regulatory, and financial management. We also have leaders who can collect financial intelligence and disseminate actionable outcomes.

- With success in similar partnership models, our Digital Foresight solutions have been successful in providing critical, actionable, lender intelligence.