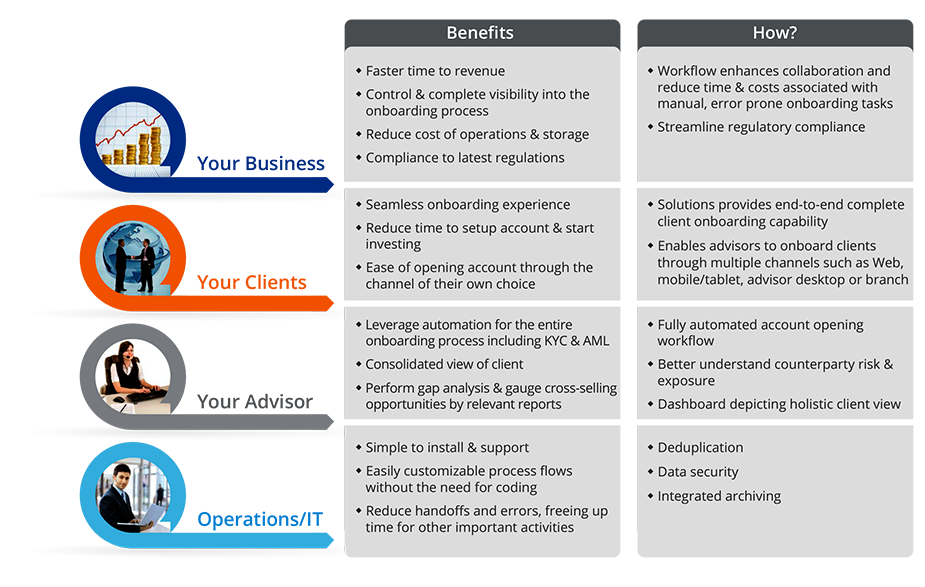

A user-friendly onboarding process creates a long-lasting, favorable first impression on customers. It is a complex process that directly impacts revenue in-flows. Financial institutions need a holistic solution that simplifies and streamlines the account opening process, and reduces average onboarding time. Coforge help deliver a compliant, efficient client onboarding solution that drives value across the business and provides the best possible beginning of client relationships. Our multi-device and mobile friendly onboarding solution helps wealth advisors gain new clients and meet the challenge of an ever-changing regulatory environment.

Build Durable Relationships, Grow Market Share

Financial institutions desire to give smooth, trouble-free on-boarding that sets the tone for a long term relationship with the client. However, firms face a multitude of challenges such as complex account opening procedures, new regulatory mandates, cumbersome manual and paper-based processes, and siloed legacy systems. To meet the demand of reducing the client on-boarding cycle, organizations need to focus on simplifying and streamlining the entire process.

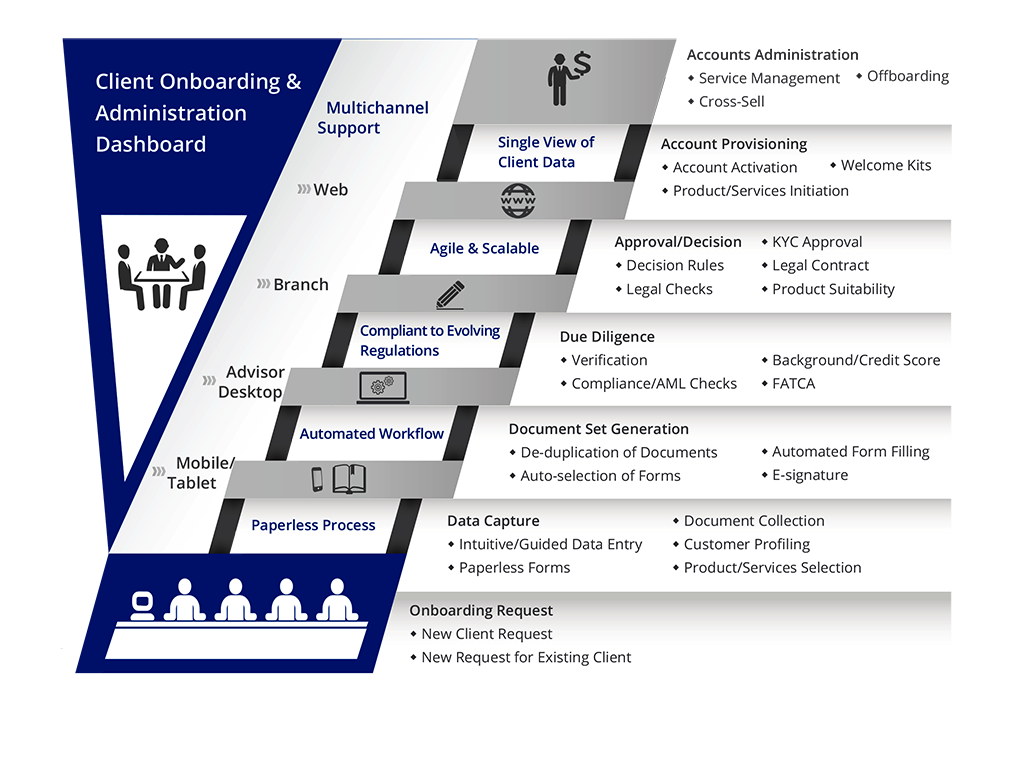

We provide a workflow-driven, comprehensive client on-boarding and account management solution that streamlines the entire new account enrollment process from electronic application to provisioning. From the initial customer meeting right up to the stage of capturing documents, information is integrated with business processes and routed through defined approval and compliance workflows.

Our Solution

We with our significant experience in IT and BPO across the Wealth Management space can deliver the following IT-based and business-based solutions for financial institutions:

IT-based Offerings

- Client on-boarding workflow design

- Enablement and integration of platform components

- Automating client/account management process via workflow solutions

- Unified GUI for onboarding with rules engine

- Unified GUI for onboarding with rules engine

- Workflows to automate routine tasks and complex processes including hand-offs

- Integration with accounting platform, imaging/document management, Know Your Customer (KYC), and Customer Relationship Management (CRM) systems

- Reporting dashboard that allow users to see request status in real-time with alerts/notifications

- Multi-channel support

- Tablet/Mobile interface

- Sales Force Developer Community (SFDC) CRM and Wealth Advisor Desktop solutions

Business Offerings

Working with leading financial services firms, we have developed expertise on client onboarding. All our solutions are well adapted to the changing regulations.

- Client data maintenance services

- KYC operating model definition and implementation

- Compliance Services (KYC/FATCA) involving both platform implementation and operations management

- Onboarding, offboarding, and account maintenance processes

Key Features

We offer a BPM-based Client Onboarding and Account Management platform that enables the firms to go paperless and virtually eliminate number of NIGO (Not in Good Order) transactions. The platform can be integrated in just a few weeks’ time to revamp hundreds of manual and disconnected processes into single, streamlined onboarding process. The platform helps us deliver a seamless, multi-channel experience that spans the entire client lifecycle.

Right First Time to Deliver More Value

Right First Time to Deliver More Value

Case Study

Case Study

Success Story 1: Streamlines Account Opening Functionality for an Independent Broker Dealer

A large independent broker dealer partnered with Coforge to streamline its account opening functionality. The engagement helped the client reduce the account setup time from 1.5 months to 2-3 weeks and enhanced the account opening experience of more than 7100 customers.

Sucess Story 2: Delivered Accurate Alert Analysis for AML and Fraud

Coforge' ADM and support services for advisor-facing applications helped a global financial services firm to provide 40% Full-time equivalent (FTE) savings for account transfers. Our 24X7 support to manage sensitive work also ensured that the client achieved significant cost savings.

Delivering Robust Incident and Event Management Support

Our solution addresses the critical client on-boarding needs of growing businesses.

- More Power: Our powerful workflow engine orchestrates dynamic workflows through visual modeling. The solution provides dynamic and electronic in-built review and approvals. It provides easy, end-to-end integration with client-facing business processes.

- More Guidance: We provide step-by-step guidance through the process.

- More Intelligence: We provide a single product wizard that on boards all products, services, and account types.

- More Automation: All client forms and new document creation process are automated.

- More Consolidation: The client dashboard provides complete view of the client activities.

- More Mobile-friendly: The solution can work on all devices irrespective of the platform.