THE FACTS

Underwriters are no longer just responsible for risk selection and pricing, they are now expected to:

- Support Sales function and increase new business

- Significantly decrease the loss ratio

- Increase retention rates of existing customer base

The information used by underwriters can vary widely. Also, underwriting actions are not always truly risk-based, but instead influenced by:

- Market dynamics

- Subjective decision making

- External competition

Other Challenges

- Uniqueness of applicant’s data from a risk assessment standpoint

- Inefficiencies while handling huge datasets related to risk proles

- Risk selection and competitive pricing to avoid under/over pricing

- Deciding between risk averseness and applicant’s propensity to buy

ANALYST VIEW

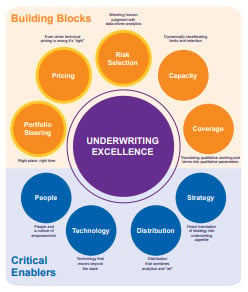

Augmenting Underwriting with AI/ML

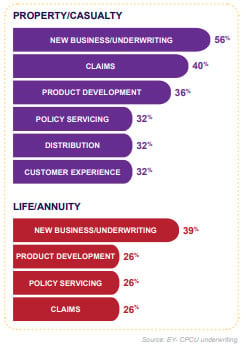

Of respondents believe that predictive model solutions are amongst the top 3 technological investments for underwriting

Machine Learning is extensively used across the Insurance value chain

Data-driven AI/ML based policy pricing and risk selection help control the Loss Ratio and contribute to Underwriting excellence

INTRODUCING SMART QUOTE, POWERED BY PEGA AI

BUSINESS PROBLEM

It is widely acknowledged within the Insurance industry that data-driven analytics based human judgment would help minimize the subjectivity in Underwriting decisions and significantly improve business efficiency

Future State/ Strategic Benefits

- Higher hit-ratio, lower loss-ratio with a more mature and self-learned predictive model

- Improved CSAT scores with possibility of offering new and highly relevant product mixes

Differentiators

- Pega predictive and adaptive modeling covering the real-time aspects of business

- Providing a holistic risk assessment of the act to aid better business decisions

Solution Overview

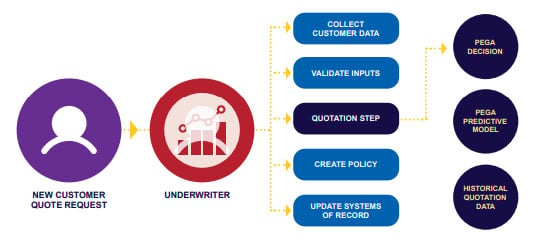

Powered by Pega AI/ML based decisioning models, Smart Quote will augment the Underwriting process by:

- Providing real-time quote acceptance propensity

- Underwriter decision feedback loops into the predictive model

- Customer risk data from D&B and Pitney Bowes

- Data driven Pega Predictive models

ADOPTION OF SMART QUOTE

Scope of Activities

Duration for Discovery (1 week) and Dev: 4 - 5 weeks

- Understanding of AS-IS workflow and business use case

- Extract historic data and create the prediction model

- Create the Pega Decision Strategy and link to data model

- Link Decision Strategy to Underwriter workflow

- Creation of Underwriter UI components

SIT/UAT/Go-Live: Along with next release of the Underwriting application

Team: 1 Business Analyst, 1 Pega Developer, 1 Data Analyst

Pre-requisites

- Pega 7.x or 8.x platform license, Pega Decisioning license

- Datasets with good Data Quality and Quantity of data of at least 1 - 2 years

- Unbiased data which is representative and balanced

Commercials

- Smart Quote framework provided free of charge

- 4-6 week framework customization cost to be provided to the customer as part of consultation process