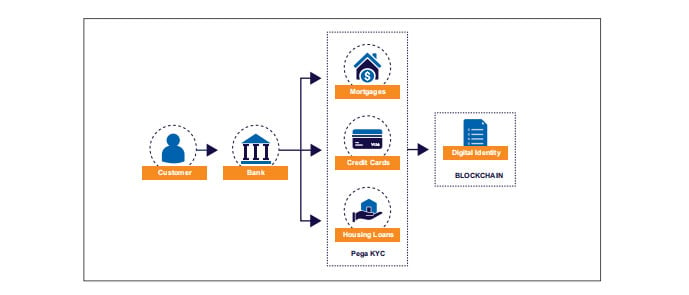

Leveraging Pega and Blockchain to Support the KYC Process

Know Your Customer (KYC) processes require organizations to validate and verify primary documents as part of the due diligence protocol. While the market is flooded with KYC utilities; regulations are such that the task of investigation and due diligence is still handled by the onboarding teams, given the business and reputational risks involved. This KYC process is known to delay business as it can take 30 to 50 days to complete the validation process.

KYC validation in a bank is often marred by poor customer experience which includes interruptions, excessive documentation and a complete lack of customer transparency over usage of their private data.

Business Challenges

- KYC checks are manual and require trained staff to examine identity evidence provided by the customer

- Data quality issues often create a need to revert to manual processing which is costly and inefficient

- Repeated KYC checks for customers when new services are introduced, resulting in a poor customer experience

How Blockchain Can Help

With appropriate commercial arrangements in place, Blockchain technology enables banks to share KYC costs, resulting in significant cost savings across the industry.

Empowering Customers with Self-sovereign Identity:

The idea of “self-sovereign” identity, where people and businesses can store and manage their own identities and provide it as and when required, without relying on a central repository, is rapidly gaining ground in the banking industry. This provides transparency to the individual that wants to know what data is held about them and who can access it. There are limitations to the adoption of Blockchain but Coforge has worked to overcome such obstacles leveraging the Pega KYC framework.

Coforge’ s Blockchain Accelerator for Pega CLM Strategic App enables

- Customer authentication to access/validate documents on the Blockchain

- Documents validity period to re-initiate the KYC checks for a new service/product

- Seamless integration with Blockchain to autocomplete key due diligence checks

Business Benefits:

- Improved customer experience

- Cost reduction

- Improved compliance

- Digital notarization

- Universal traceability

- Proof of process reporting