The insurance industry is witnessing significant signs of change and of massive progress. While a few insurance companies are experimenting with new technologies and collaborating with Insurtechs to build new models and tools to speed up their current digital roadmaps, others are using rapid Minimum Viable Product (MVP) methodology and Proof of Concept (POC) to drive business impact by quickly moving these into production. According to a KPMG report from 2020, 85% of Insurance CEOs say that the pandemic has accelerated the digitization of operations and the creation of next-generation operating models.

Source: KPMG

The recent disruptions from the pandemic has provided the P&C insurance companies a big opportunity to evaluate the crisis and get prepared to embrace automation, in order to provide innovative technology solutions at a much faster pace. Now, even more, they need to adopt new technologies and transform legacy systems and related processes to achieve better efficiency and speed. But achieving this is a big challenge due to several impediments - such as limited time, limited staff, and poor data quality. Other contributing factors from the same report - lack of insight into the future of operational scenarios, difficulty in making quick and major technology related decisions, challenges in moving from pilot and experiments to scaled deployments, lack of coherent views on key technology trends on which to act and lack of skills and capability in IT organizations.

Source: KPMG

What is disrupting the status quo in the insurance industry at such a fast pace? Apart from the pandemic, there are 3 key factors contributing to rapid disruption:

-

- The rise of insurance-tech companies

Insurance-tech companies (InsurTechs) are redefining the customer experience via innovations. These new entrants in the industry are chipping away at the traditional insurer’s market by offering digital convenience and customized products to customers. InsurTechs are not a temporary disruption, they are fast becoming an integral part of the P&C industry. As the pandemic and other business changes make the insurances process even more complex, it is becoming imperative for businesses to opt for digitized solutions and offering services that can help them stay ahead of the competitors by scaling and speeding up their operational processes.

-

- Volatile consumer behaviour

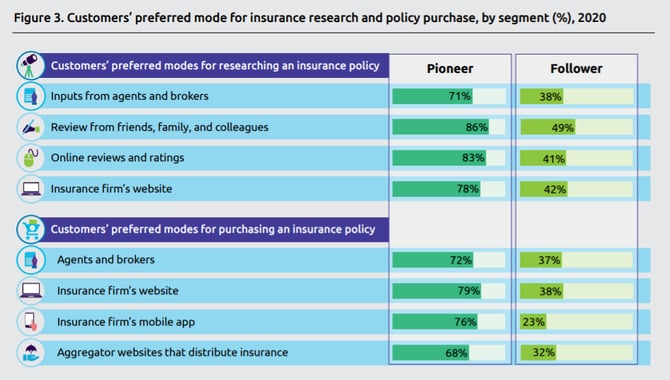

Today’s consumers are tech savvy, and highly demanding. They spend a majority of their time researching and getting advice and guidance on the complexities of insurance digitally, rather than having a face to face or even a phone conversation. Such informed, well connected, demanding and value-conscious consumers are forcing P&C insurers to become conscious of maintaining their brand image and focus even more on customer experience that they deliver. Anticipating business impact and becoming agile enough to quickly adapt to market changes will help P&C insurers in the coming years.

Source: WorldInsuranceReport.com

-

- Quick introduction of Advanced technologies

The pandemic has heightened the sense of urgency for P&C companies to embrace digital transformation efforts, and to collaborate with InsurTechs for efficiency. As consumers have quickly adapted to online channels and increasingly prefer to transact digitally from start to finish, it is becoming crucial for P&C insurers to offer digital engagement at all touch-points as they compete with new, non-traditional players who have entered the insurance markets with this already in place. All Insurance players, whether big or small, are searching for technology solutions to scale up to the changing demands in order to keep up. P&C carriers need to be on the lookout for the latest and best developments in insurance technologies. This will help them stay ahead of competitors and deliver the immersive experiences that customers expect in the modern market.

According to a 2021 McKinsey Report “The disruption from COVID-19 changed the timelines for the adoption of AI by significantly accelerating digitization for insurers. Virtually overnight, organizations had to adjust to accommodate remote workforces, expand their digital capabilities to support distribution, and upgrade their online channels. While most organizations likely didn't invest heavily in AI during the pandemic, the increased emphasis on digital technologies and a greater willingness to embrace change will put them in a better position to incorporate AI into their operations.”

Source: Mckinsey.com

The need to accelerate the use of Automation It is a myth that automation implies huge investment. Automation, if implemented smartly using a segmented approach or an end-to-end but functional approach, can lead to quicker cost optimization rather than an increased costs even in the short term. It is possible to integrate technology and give results quickly. Legacy systems can be ‘enhanced’ with newer accelerators and platforms that work side-by-side with traditional systems. A complete digital transformation may need leveraging multiple types of technologies - intelligent automation instead smartly makes use of technology to enhance the organization’s processes supported by analytics, RPA/IPA and decisioning via Artificial Intelligence/ Machine Learning.

-

- Intelligent Automation: Intelligent Automation (IA) would mean an end-to-end solution to the digital transformation based on the entire BPM, tasks, systems, RPA, users, based on the business needs of the P&C Insurance companies. It would take into consideration few more aspects such as use of analytics and AI/ML for automated and intelligent decisions. One critical area of concern is seamless integration between legacy systems and the new systems used in the company that needs to be handled carefully. Integration of systems would stop duplication of data and users will need to use only a single platform.

-

- Smart Business Process Management (BPM) or Smart BPS (Business Process Solutions): Smart BPM focuses on two vital aspects:

- Service Delivery and

- Service Assurance

Smart BPM is a way to deliver on the above using an optimized blend of domain expertise, business process management experience combined with the right technology intervention. This combination improves the value chain while addressing automated business process discovery, predictive analysis, smart business process validation, smart process framework mapping, and automated business process guidance. Front office, middle office and back office operations are all covered, and any longer-term or hard-to-automate functions may even be carried out manually. Intelligent automation and smart BPM can be used to:

-

- To boost productivity

- To save time by automation

- To improve the customer experience

- To improve employee experience

- To reduce errors in the insurance processes

Role of business process services and automation providers Intelligent automation is a fluid mix of manual to automated or even automated to manual transitions to optimize quick results in cost savings, turn time improvement, quality improvements all with the goal of better customer experience and higher profitability. This combination may sometimes be hard to find in-house – specially as technology changes quickly. So organizations seek out providers who have expertise in both business process management, and in technology automation, to help them through these changes.

Coforge Business Process Solutions (BPS) is one such provider of intelligent automation and Smart BPM for financial services. As a global provider of digital platforms and business process management solutions, it is backed by a team of nearly 20,000+ technology and services professionals, providing customized services that streamline and transform processes across the Banking, Mortgage, Title Insurance & Tax, Consumer Lending and Insurance industries. Coforge partners with several Top 25 U.S. Banks, Top 10 Mortgage Lenders, Insurance Intermediaries and Fortune 500 companies. Their suite of business process services, omni-channel contact center solutions, Quality Control CoE and data & analytics capabilities is helping insurance carriers, brokers and managing general agents transform their insurance operations and achieve:

-

- 100% adherence to compliance & business rules

- Reduce business risk with a Quality Control CoE offering automated & manual QC support

- 40% cost savings & 15% efficiency improvement

- Increase efficiency & reduce costs with business process services & a global delivery model

- Enhance customer experience

- Provide quicker response times with 24*7 omni-channel contact center services

Our Insurance-dedicated professionals already support the processing of over 12M Insurance documents, data verification/QC of over 9M documents and over 2.3M contact center calls annually. For more information/success stories, check the following links:

Conclusion:

The P&C industry needs to embark on major automation transformation over the next few years, with particular focus on accelerating processes and enhancing the entire workflow. Automation must be implemented with consideration to technology as well as supported by smarter processes. The use of Intelligent automation (technology interventions with quick ROI) and smarter BPM (business process solutions that assure consistent customer experience without disruption during this transition) are the most direct path to this necessary transformation, whether this transition is done in-house or with the help of a focused external partner. This is needed quickly to stay competitive and to grow as InsurTechs and other players compete with the Insurance industry.