The US economy is in great shape! It’s never been this strong in a long time. In response to this, the Federal Reserve has chosen to increase interest rates to keep this rapidly expanding economy on an even level given its quickening growth. Central bank officials voted unanimously to raise the benchmark federal-funds rate by a quarter-percentage point to a range between 1.75% and 2%. One reason for this view is that the economy is firing on nearly all cylinders with record low unemployment, which is very close to the Fed’s definition of “full unemployment”. This, along with surging consumer and business confidence, is positive for the real estate sector.

According to Sam Khater, Chief Economist at Freddie Mac (as quoted in DSnews.com), and the Fed rate hikes are less likely to impact long-term mortgage loan borrowers this time around. "The Federal Reserve announced their decision to raise the federal funds rate by 25 basis points," he said. "One thing to point out is that there are fewer consumers today whose debt is tied to short-term rates, and because the majority of consumer debt is from mortgages, this means the recent short-term rate hikes will be less impactful than what was seen in the mid-2000s."

How will this affect the mortgage lending business?

As positive as that may sound, we cannot ignore the fact that this will impact the mortgage lending business further. 2018 itself brought a lull with lower volumes because of higher interest rates. With a further increase in rates, the lending industry will face even lower volumes, rising expenses and reducing margins, and increased competition. 2018 is really a game changer – the fittest will survive, while the others will forfeit.

To top it all, going forward, the outlook seems even less promising given that most Fed officials expect that the central bank will probably raise rates at least three more times next year and at least once more the year after, leaving rates in a range between 3.25% and 3.5% by the end of 2020.

The scenarios that will be playing out 1. Further decline in mortgage origination volume

Rates on mortgages, which account for the biggest chunk of U.S. household borrowing, are at their highest levels since 2013. According to Freddie Mac (published in the wall street journal), the average fixed 30-year rate has moved from 3.95% to 4.54%. If compared to the previous years, this rate seems moderate. However, the increase is considerable enough to increase the monthly mortgage of an average priced home by approximately $100 (for loans with 20% down payment).

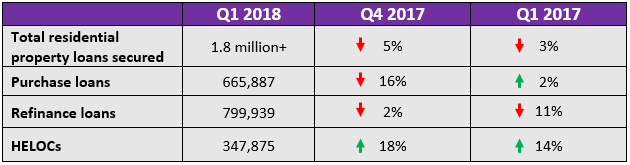

Recent numbers published by ATTOM Data Solutions’ Q1 2018 U.S. Residential Property Loan Origination Report, shows how originations are declining:

Although refinance is more impacted by rising rates, everyone in the lending industry is aware that the rate hikes aren’t good for the purchase market either. Even with low unemployment and an increase in consumer confidence, borrowers looking for new homes hesitate as rising rates increase their monthly payments or reduce in the size of the loan they may be eligible for. Of course, existing borrowers seeking to refinance to lower rates stay out of the market as well.

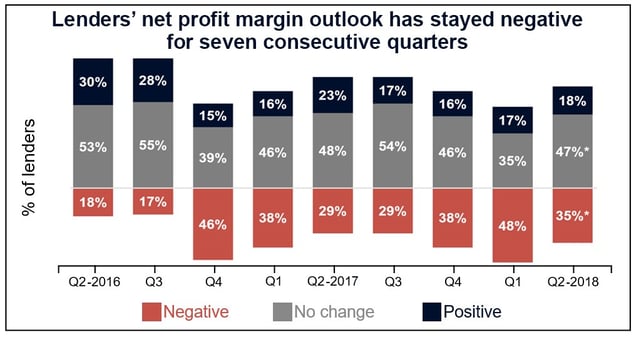

The market slowdown is also because of a couple of other factors, according to Fannie Mae's Q2 2018 Mortgage Lender Sentiment Survey (July 2018, www.fannie.com). Lenders have reported that their profit margins have gone down for the seventh consecutive quarter now. The reason – rising home prices and low inventory. These two critical factors in the housing industry have led to a considerable decrease in mortgage demand. Also, tracking the demand for refinance over the last 3 months, lenders have concluded that the numbers have reached their lowest level since Q2 2014.

In a recent article by Fannie Mae (June 2018) their senior vice president and chief economist Doug Duncan said, "Lenders remain bearish this quarter as they continue to face headwinds from rising mortgage rates, tight supply, and strong home price appreciation, which have drastically reduced refinance activity and restrained home purchase affordability."

Source: Fannie Mae's Q2 2018 Mortgage Lender Sentiment Survey

With the recent rate hikes, lenders will face a further lowering of mortgage origination volumes and increased competition. One of the only ways to sustain profitability, or in some cases even break even or survive, in this volatile market, will be cost-cutting. Lenders will have turn to smarter ways of doing business to keep their business solvent. This may be payroll reduction, automation, technology or simple process-reengineering. Let’s face it, there is no single way of doing this right. The best approach may be to use a combination of optimum processes coupled with suitable technology.

2. The climbing cost of origination

The rising interest rates and declining volumes had already seen the cost of origination soar through the roof. Independent mortgage banks and mortgage subsidiaries have already recorded a net production loss of $118 per loan in the first quarter of 2018. If compared to Q4 2017, this number is down from a net gain of $237 per loan and basis Q1 2017, down from the net gain of $224 per loan. As per a recent article in National Mortgage news, Marina Walsh, the MBA's vice president of industry analysis mentioned, “This is the second time in the nearly 10-year history of the MBA's Quarterly Mortgage Bankers Performance Report that lenders lost money originating mortgages. The last time, in the first quarter of 2014, lenders posted a net production loss of $194 per loan. In the first quarter of 2018, falling volume drove net production profitability into the red for only the second time since the inception of our report in the third quarter of 2008. While production revenues per loan actually increased in the first quarter, we also reached a study-high for total production expenses at $8,957 per loan, as volume dropped.”

There may a foreseeable jump in the cost of doing originating a loan as the Fed raises interest rates, and volumes decline further, while fixed costs remain relatively high.

The tussle to keep costs low, trying to gain market share while overall volumes shrink, will drive lenders to rethink their strategies. This market will not entertain the mundane and traditional ways of doing business. Lenders will be forced to innovate, rethink and be smart in their processes. This market trend is here to stay and those that choose to be complacent will be looking at an abyss. The numbers have validated this.

3. HELOCs will rise further

The impact of the Fed hike will be felt on HELOCs immediately. In an interview published by DSnews, Holden Lewis, research analyst at NerdWallet confirmed, “With the Fed increasing the federal funds rate, the interest rates on credit cards and HELOCs will rise within a billing cycle or two.”

As adjustable rate mortgages (ARMs) and HELOCs are directly affected by short-term rates, they will get impacted immediately. While this looks good for the loan originator, we in the lending industry are aware that HELOCs do not drive profit margins. The only game that lenders must gear up for is to try and make the most progress in the purchase market, retain or gain market share and implement smarter processes to remain cost-effective.

For more information on ways to implement technology-enabled ready solutions for the mortgage industry, cut costs and implement process-reengineering, visit Coforge BPS’s website www.coforge.com/bps