A property tax is a tax levied on "real property" (land and buildings, both residential and commercial) or personal property (business equipment, inventories, and noncommercial motor vehicles). Taxpayers in all 50 states and the District of Columbia pay property taxes. But the tax on "real property" is primarily levied by local governments (cities, counties, and school districts) rather than state governments.

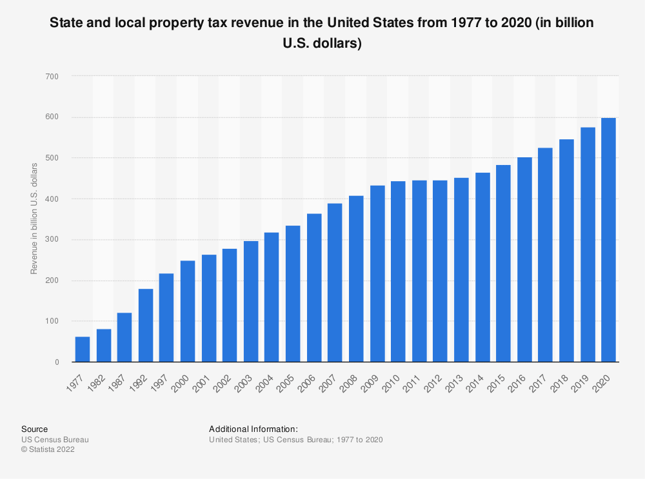

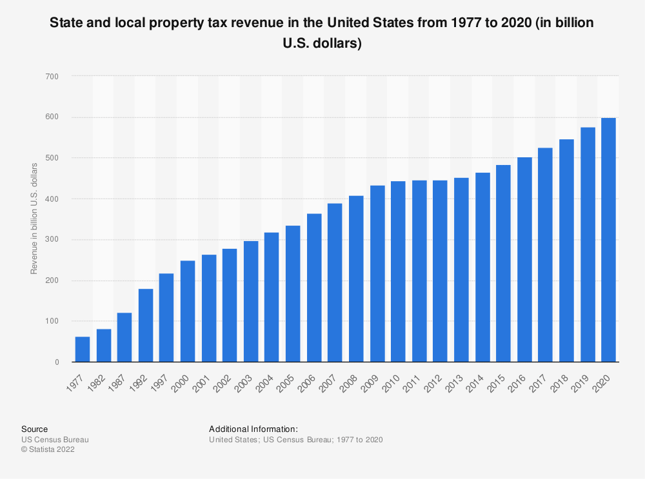

Property tax receipts in the United States from 1977 through 2020

Property taxes in the United States were estimated to have brought in roughly $599.99 billion in 2020.

There is no problem if the relevant property owner is making sure that property taxes are being paid on time, and the paid amounts are correct. However, with multiple local governments responsible for property taxes governance and with so many properties to make the payments for, there are bound to be errors and missed payments.

Penalties for delinquencies

In the context of property tax payments, the first impact of delinquencies on property tax is penalties that it attracts - ranging from 12% - 18% per annum. These start adding up very quickly for large residential portfolios and even smaller commercial portfolios as commercial portfolios contain large loan amounts.

In addition, portfolios have constantly changing loan ownership and even tax due date changes (more so for commercial properties). This becomes even harder to manage for a large portfolio of loans.

Compliance with rules governing property taxes

Tax authorities have specific rules that must be adhered to while paying taxes. In addition to having a thorough understanding of the regulations governing tax payments and deadlines, banks, credit cooperatives, and tax servicing agencies must also keep track of these regulations for the loan portfolios they are overseeing to ensure that every loan is in compliance. This is often a daunting task.

Further issues from delinquencies

Delinquent tax repayments can have substantial repercussions in the context of real estate, involving back taxes, penalties, as well as the possibility of foreclosure. Both the borrower—a residential or company owner - and the lender are under a great deal of stress as a result.

Taxing officials may decide to sell all past-due payments to a 3rd party buyer on occasion rather than dealing with unpaid taxes. This buyer then assumes the role of the principal lien holder on the delinquent assets. Now, in addition to paying back penalties and taxes, the borrower or lender must additionally pay extra fees requested by the third-party tax buyer.

Here’s How You Can Avoid Delinquencies

To avoid penalties and fees (and in the worst case foreclosure), both residential and commercial properties require accurate, timely, and consistent tax payments to the governing tax authority.

Servicers can keep up with tax payment deadlines, changes to the tax code, compliance requirements, etc. internally, but it is a difficult process. Owners of loan portfolios may find that outsourcing this to a real estate taxes service company with expertise in this area is considerably simpler, secure, and more economical. There are numerous such commercial entities, some of which are extremely large and have basic offers, while others offer more individualized, adaptable services, such as the Real Estate Tax Service from Coforge.

It's crucial to realize that a problem with paying property taxes not only affects the owner of the loan portfolio, but also the loan portfolio owner's (servicer's) client, who may be a borrower or a business proprietor. The loan portfolio owner must make sure that outsourcing such a function won't damage the connection with the servicer's consumer before doing so. The ideal option might be a vendor who offers the right level of care and can adapt the solution to the features of the loan portfolio.

One technology-enabled solution that is being used by 2 of the Top 5 largest servicers in the U.S.

To help servicers obtain the maximum control and visibility over their marketing portfolio, the RETS platform (Real Estate Tax Service) offers end-to-end real estate tax reporting and monitoring. It can offer customized service to customers because it was created with the aid of cutting-edge technologies and years of expert experience. In addition to working as an independent information and/or tax service provider, RETS can be connected with solutions for servicing both residential and commercial loans.

Delivering tax payments with an accuracy of 99.999%, or almost six sigma levels has been made possible by RETS. It offers tailored solutions and, based on the loan portfolio, could provide tax payment processing for up to 20% less than market charges, making it an option that is quickly acquiring market share. RETS platform is a proprietary solution offered by Coforge.

-1.png?width=1813&height=490&upsize=true&upscale=true&name=HB%20Item%202%20(3)-1.png)