In a world where digital transformation defines competitive advantage, banks and financial institutions are under intensifying pressure to deliver innovation, maintain compliance, enhance customer experience, and cut costs simultaneously. Platform-based cost optimization is one of the most powerful levers for achieving this elusive balance.

Far beyond a technical refresh, optimizing core banking platforms is a strategic imperative. It has the potential to dismantle inefficiencies, rationalize IT spending, and create a launchpad for sustained innovation. Platform optimization offers a pathway to agility and resilience for institutions navigating margin pressure and legacy system complexity.

Why Legacy Platforms Are No Longer Sustainable

Many banks still rely on decades-old platforms - patchworked, siloed, and expensive to maintain. These systems consume an outsized share of IT budgets, slow down innovation, and expose institutions to heightened security and compliance risks. Every new feature, regulation, or customer demand becomes a struggle, shackled by inflexible architectures and opaque data flows.

Platform modernization isn't just about saving money but redefining what's possible.

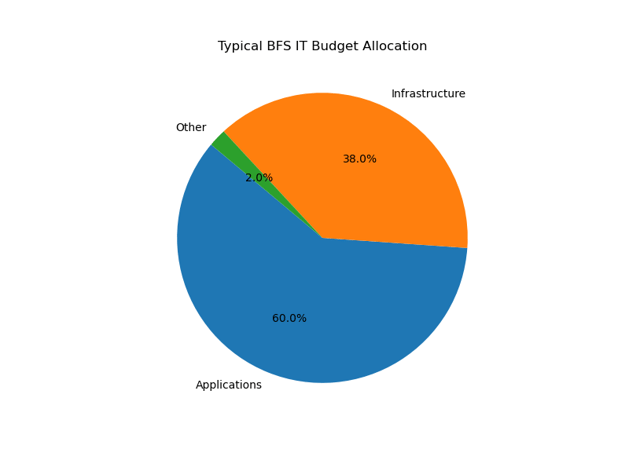

Key Cost Drivers in Today’s Banking Platforms

Let’s break down the primary factors inflating IT costs in banking:

- Core Banking System Maintenance: Legacy systems often demand constant patching, customization, and vendor support. While essential for stability, these recurring expenses drain financial and human resources.

- Redundant Platforms: Mergers, acquisitions, and siloed business units have led to duplicate platforms performing similar functions, resulting in unnecessary licensing, infrastructure, and staffing costs.

- Fragmented Integrations: Without standardized data models or APIs, integration between systems becomes a custom (read: costly) endeavor, delaying projects and limiting interoperability.

- Vendor Lock-in: Long-term contracts with proprietary platforms restrict flexibility and force institutions into expensive upgrades or additional modules to meet changing needs.

- Regulatory Pressure: Compliance requirements are evolving rapidly. Meeting them requires investments in skilled talent and technologies, which often absorb 10% or more of IT budgets.

Strategic Levers to Optimize Platform Costs

Modern banks are shifting from reactive upgrades to proactive platform strategies. Below are the key modernization paths banks can take to achieve sustainable cost reductions:

1. Platform Consolidation

Reducing the number of platforms in use across business lines minimizes licensing costs, streamlines operations, and enhances data consistency. Consolidation also simplifies integration, lowers support burdens, and reduces redundancy - unlocking immediate cost savings.

2. Core Banking Modernization

a. Progressive Module Replacement

Rather than overhauling the entire system, banks can phase out specific high-maintenance modules, such as loans or payments, with modern alternatives. This balanced approach can deliver 15–25% cost savings while limiting disruption.

b. Greenfield Implementation

Launching new products on separate, cloud-native platforms enables banks to bypass legacy constraints. These “clean slate” approaches can slash costs by up to 70% for new offerings, accelerate go-to-market timelines, and allow for greater agility.

c. Cloud-Native Core Systems

Migrating to cloud-based cores replaces capital-intensive infrastructure with scalable, consumption-based pricing models. These platforms also automate regulatory updates and simplify maintenance, leading to 30–50% infrastructure cost savings.

d. Hollowing the Core

Non-critical functions like compliance reporting or analytics can be decoupled from the core system and shifted to specialized third-party platforms. This strategy delivers quick wins, with up to 40% IT cost reductions by eliminating resource-intensive processes.

e. Full Rip-and-Replace

Though bold and resource-intensive, a complete overhaul of legacy systems removes long-term technical debt. Over 3–5 years, such transformations can yield 25–40% in cumulative savings by eradicating legacy costs and enabling a future-proof architecture.

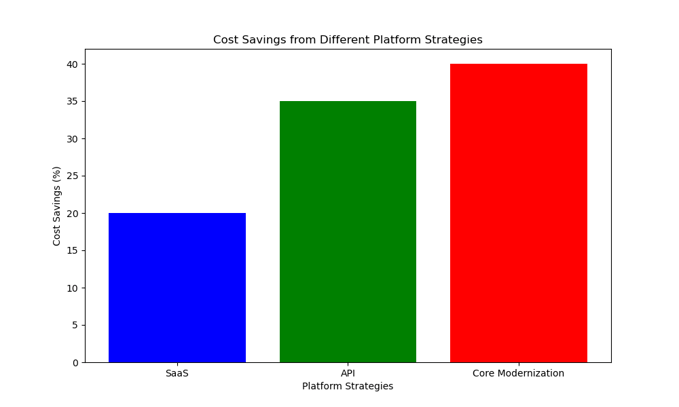

3. SaaS Adoption

SaaS solutions for non-core functions like HR, CRM, and compliance offer a compelling case. They are easy to deploy, follow pay-as-you-go models, and reduce both CapEx and ongoing maintenance. Coforge, for instance, has helped major U.S. banks save up to 20% in loan servicing operations through targeted SaaS implementations.

4. Building a Future-Ready API Strategy

Open APIs are the bedrock of composable, modern banking ecosystems. They simplify integration, reduce custom development needs, and enable real-time access to data. Coforge’s API strategies have allowed clients to cut integration costs by up to 35%, accelerate digital service launches, and enhance operational responsiveness.

Risks to Navigate

As transformative as these strategies are, modernization initiatives are not without risks. However, with proper foresight and planning, these challenges can be mitigated:

- Implementation Costs & Complexity: A phased rollout reduces disruption and allows for iterative testing and learning. Strong governance ensures projects remain aligned with timelines and budgets.

- Data Migration Hazards: Transitioning from legacy systems requires clean data. Pre-migration audits, automated migration tools, and strong recovery protocols are essential to avoid costly errors or downtime.

- Vendor Lock-In: Banks should insist on open standards and negotiate exit clauses in vendor contracts to preserve flexibility and negotiating power.

- Security & Compliance Risks: Robust security frameworks are critical, especially for APIs and cloud solutions. Zero-trust models, encryption, and continuous monitoring are now non-negotiable in ensuring data privacy and regulatory compliance.

The Way Forward: From Cost Center to Strategic Asset

Platform modernization is not a one-time event—it’s a continuous transformation journey. Banks must approach it with a long-term vision, linking platform decisions directly to business outcomes. The goal isn’t merely cost containment - it’s value creation through agility, scalability, and innovation readiness.

Ultimately, the path you take, whether progressive replacement, greenfield builds, cloud migration, or API-led modernization, must be tailored to your organization’s goals, maturity, and risk appetite.

Conclusion: How Coforge Can Help

Coforge brings a strategic, end-to-end approach to platform-based cost optimization for banks and financial institutions. With deep domain expertise in BFS, a rich ecosystem of partnerships, and proprietary accelerators, Coforge enables:

- Platform consolidation and modernization at scale

- Cloud-native migrations with embedded compliance frameworks

- SaaS implementation for faster ROI and lower TCO

- API-led transformation for integration, agility, and innovation

- Modular delivery frameworks to manage cost and complexity

- Robust security and data governance layers

From helping banks decouple legacy cores to enabling cloud-native launches of new offerings, Coforge partners with clients to architect the future of banking - efficient, secure, and digitally empowered.

Ready to Transform?

Platform optimization is no longer optional; it’s foundational. Let Coforge help you transform your technology stack into a catalyst for cost savings and future growth.