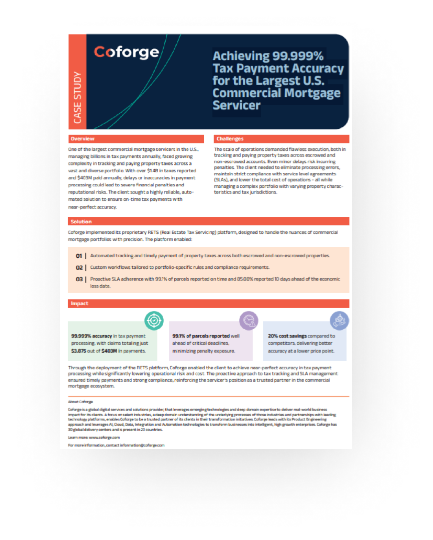

Achieving 99.999% Tax Payment Accuracy for the Largest U.S. Commercial Mortgage Servicer

Precision at Scale: Transforming Tax Payment Accuracy for a Leading U.S. Mortgage Servicer

One of the largest commercial mortgage servicers in the U.S., managing over $1.4B in property taxes annually, faced increasing complexity in ensuring timely and accurate tax payments across a vast and diverse portfolio. With reputational risk and financial penalties on the line, the client needed a scalable, automated solution to eliminate errors, meet strict SLAs, and lower operational costs.

Coforge implemented its proprietary RETS (Real Estate Tax Servicing) platform to deliver 99.999% payment accuracy and 20% cost savings. The solution enabled seamless tracking and payment of taxes for escrowed and non-escrowed accounts, proactive SLA adherence, and jurisdiction-specific workflows. With 99.1% of parcels reported ahead of deadlines and only $3,875 in claims on $403M paid, the client achieved unmatched accuracy, compliance, and efficiency.

Read the full case study to discover how Coforge delivered near-perfect precision and risk-free operations at scale.