Photo by Andrea Piacquadio: https://www.pexels.com/photo/man-wearing-white-virtual-reality-goggles-834949/

How would you feel if you were seated comfortably in your living room but could still visit any bank branch in your city, without actually going to that location? Wouldn’t that be absolutely great?! You can do this in metaverse. Banking in metaverse relates to the management of financial transactions in virtual environments. In metaverse, users can create and customize their own avatars. Metaverse provides an immersive experience in a simulated environment. The metaverse, which is built on technologies like augmented reality (AR), virtual reality (VR) and the blockchain, is a place where people can meet, interact, and where digital assets (land, buildings, items and avatars) can be bought and sold.

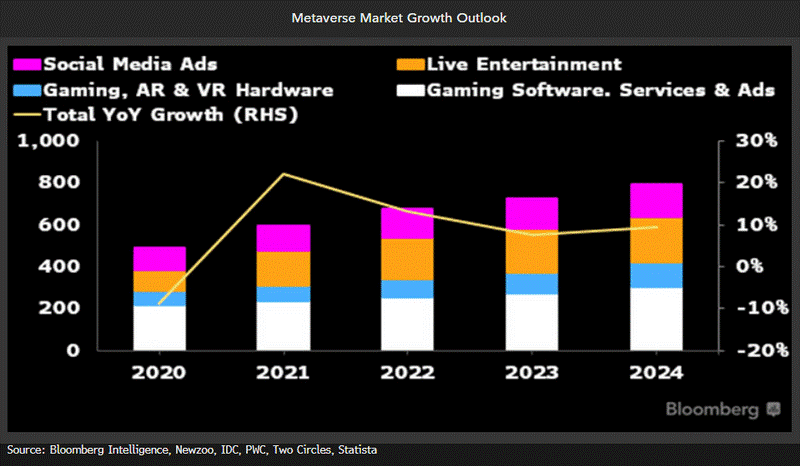

Metaverse is continuously evolving with rapidly emerging capabilities, use cases, experiences and technologies. Studies on metaverse show huge potential in the fields of banking, healthcare, architecture, gaming, social media etc. As per a report by Bloomberg Intelligence, the metaverse market is expected to be worth $800 billion by 2024.

Source :https://www.bloomberg.com/professional/blog/metaverse-may-be-800-billion-market-next-tech-platform/

In the virtual world, people can transact just the way they do in the real world. This opens up enormous underlying opportunities for banks. Here are a few points that suggest to us how metaverse could help the banking industry:

- Virtual Branch –

An important use case for banking in metaverse is to visit a bank branch virtually. There could be a pin and password that could help the customer to enter the virtual bank branch in the form of his personalised avatar. Avatars of relationship managers and other bankers will engage him. This can offer clients the ability to check balances, pay bills, make transfers using AR/VR channels. - Financial Advice

With the onset of Coronavirus pandemic, there has been a huge change in customer behaviour. They are more inclined and attracted towards remotely provided services. With metaverse, financial reviews, financial planning, mortgage advice delivery, virtual annual portfolio reviews etc. can happen virtually and more conveniently. Though online banking provides services remotely, it lacks the feel of a human touch. With metaverse, banks can provide services remotely but with a human touch which will deepen customer interactions and relations significantly. - New products like digital currency and NFTs-

In a virtual world, there are multiple means and mechanisms through which people are transacting digitally such as cryptocurrencies and non-fungible tokens (NFTs). With time, these cryptocurrency tokens can appreciate in value and bring in huge profits. As people are ready to spend real money to own virtual assets, digital assets are now exchanged and valued in a market. NFTs are unique tokens which can’t be interchanged. An NFT token is a kind of digital data stored in a blockchain. Banks can use this opportunity to launch Exchange traded funds(ETF). For example, two Indian Mutual Fund houses have applied for blockchain and metaverse ETFs recently. Even JP Morgan has started providing banking services to crypto exchanges Coinbase and Gemini. - Training and education-

The metaverse also provides a wonderful mode of training. Various use cases can be created like showing fund transfer, creating deposits, loans, credit cards etc. Many studies suggest that such means of training and education are lot more effective and engaging as compared to traditional ways like offline tutorials or online teaching. This can also help banks to retain customers and build loyalty. - Employee onboarding –

The trainings provided in metaverse would not only help the customers but also the employees of the bank itself. This can provide strong bonding experience and better understanding to the new joiners and would in turn make on-boarding easy and more effective. - Monetize gaming -

In recent times, more and more people got interested in virtual worlds to avoid loneliness. People prefer staying in communities. In future, Banks can connect to games in the virtual world and use this opportunity to make more money. For example, Zelf, a neobank, is building a banking system for exchanging value from virtual world to the real world. Zelf holds the game tokens and provides the player with a loan in return. If the person can’t repay, Zelf would sell the game tokens on its marketplace to other players. Read more at: https://www.americanbanker.com/list/4-ways-banks-are-experimenting-in-the-metaverse - Attract younger generation

Finally, the Banks which are stepping into the metaverse are keenly attracting the younger generation. The new generation is more tech savvy and wants way more than the traditional banking experience. Showing their presence in the metaverse would be a great branding strategy for the banks and the early adopters of metaverse may have the first mover advantage.

While many banks are still trying to understand the capabilities of Metaverse, few have already started using its capabilities. JP Morgan has become the first bank to land in metaverse by opening a lounge, named Onyx, in the blockchain-based world, Decentraland. With this, users can create their own avatars, explore and buy digital plots of land using the digital currency, Mana.

KB Kookmin Bank, one of the largest banks in South Korea, has developed KB Metaverse VR Branch Testbed (a virtual bank). Here customers can access banking services in metaverse after wearing a VR headset. Some other financial institutions like BNP Paribas and Bank of America have also placed their foot in the virtual world.

Metaverse promises to create new opportunities and change the way Banks engage with their customers. It would not be wrong to suggest that banks would thrive if they embraced metaverse and explored the opportunities presented by it.

Read more at:

https://www.fortuneindia.com/enterprise/how-banking-metaverse-will-change-the-way-you-bank/108457

https://www.americanbanker.com/list/4-ways-banks-are-experimenting-in-the-metaverse

Khushboo Goyal is working as Technical Architect. She has around 14 years of IT experience in the domain of Banking & Finance, Intellectual property rights and insurance. She has strong technology experience in the fields of AWS and Conversational AI. She has also worked on Rest API based Java/Spring applications.

Related reads.

About Coforge.

We are a global digital services and solutions provider, who leverage emerging technologies and deep domain expertise to deliver real-world business impact for our clients. A focus on very select industries, a detailed understanding of the underlying processes of those industries, and partnerships with leading platforms provide us with a distinct perspective. We lead with our product engineering approach and leverage Cloud, Data, Integration, and Automation technologies to transform client businesses into intelligent, high-growth enterprises. Our proprietary platforms power critical business processes across our core verticals. We are located in 23 countries with 30 delivery centers across nine countries.