- Home

- Services

- Digital Process Automation

- Pega

- Insurance Smart Quote

Insurance Smart Quote

Business Challenge

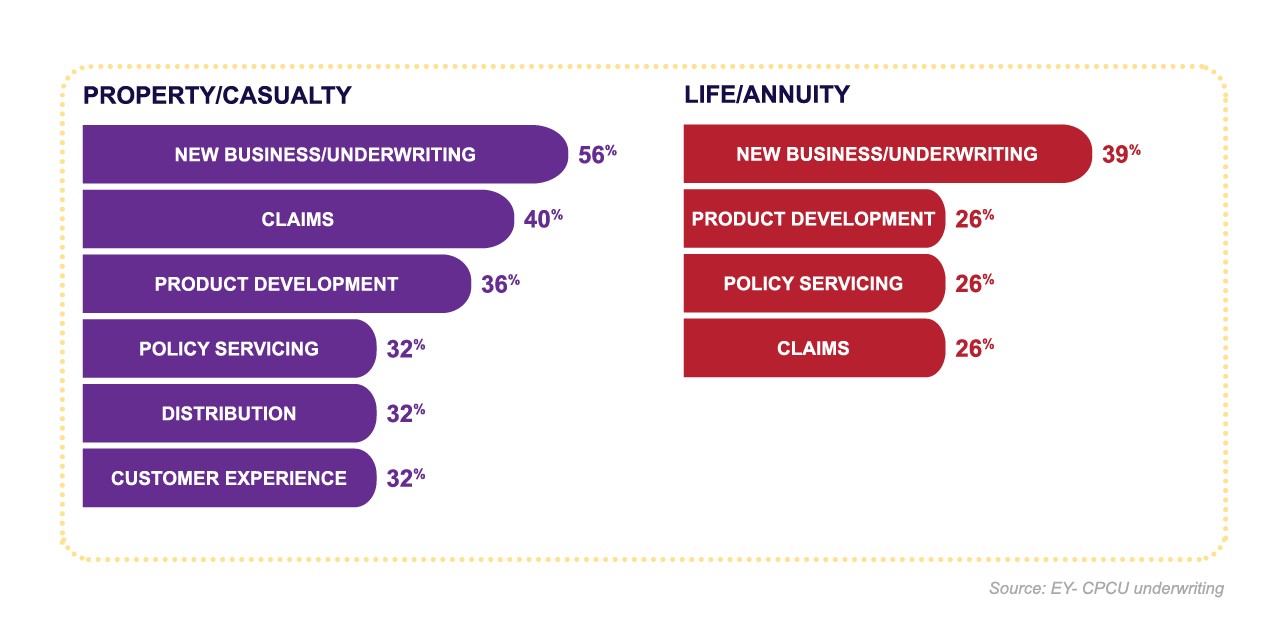

It is widely acknowledged within the Insurance industry that data-driven analytics based human judgment would help minimize the subjectivity in Underwriting decisions and significantly improve business efficiency

Other Challenges

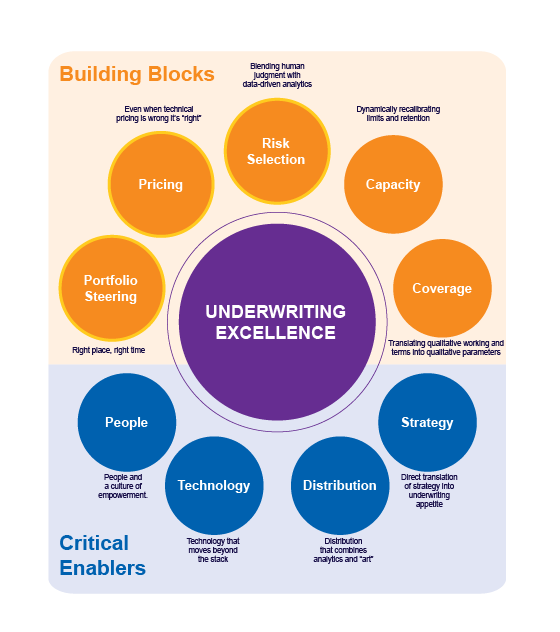

- Uniqueness of applicant’s data from a risk assessment standpoint

- Inefficiencies while handling huge datasets related to risk proles

- Risk selection and competitive pricing to avoid under/over pricing

- Deciding between risk averseness and applicant’s propensity to buy

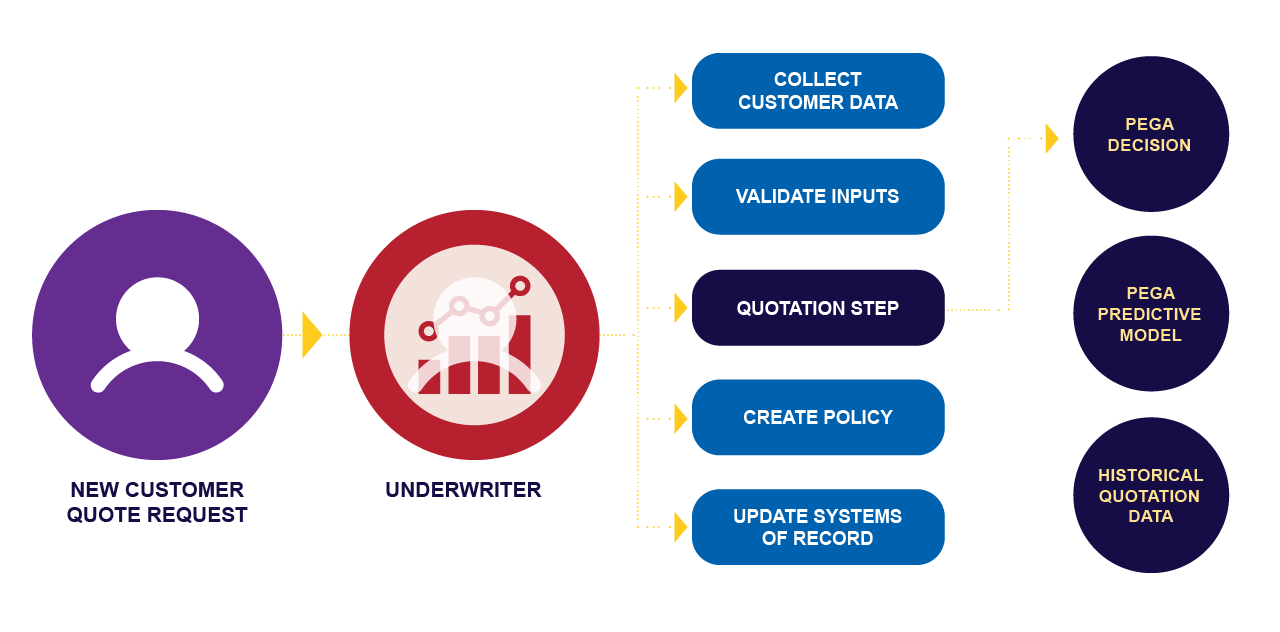

Powered by Pega AI/ML based decisioning models, Smart Quote will augment the Underwriting process by:

- Providing real-time quote acceptance propensity

- Underwriter decision feedback loops into the predictive model

- Customer risk data from D&B and Pitney Bowes

- Data driven Pega Predictive models

Underwriters are no longer just responsible for risk selection and pricing, they are now expected to:

- Support Sales function and increase new business

- Significantly decrease the loss ratio

- Increase retention rates of existing customer base

The information used by underwriters can vary widely. Also, underwriting actions are not always truly risk-based, but instead influenced by:

- Market dynamics

- Subjective decision making

- External competition

Solution Benefits

- Higher hit-ratio, lower loss-ratio with a more mature and self-learned predictive model

- Improved CSAT scores with possibility of offering

Differentiators

- Pega predictive and adaptive modelling covering the real-time aspects of business

- Providing a holistic risk assessment of the act to aid better business decisions

Let’s engage