A profound transformation is at hand, but how equipped are you to see the potential and perils of the business and technology landscape? Is your financial institution too focused on short-term tactical advantage to see the expanse of challenges and opportunities ahead? Are you meeting your customers’ demands? You can count on us to resolve these challenges through new solutions and frameworks that impact how you harness the power of your technology investments. You can also get more value from our highly skilled resources that can help you with platform-based services, consulting, and various IT services and solutions.

Global Reach, End-to-End Solutions

In today’s economy, chief financial officers aspiring to build a world-class financial organization seek financial solutions that are packaged and customized to their customers’ needs. There is no magic formula to create such solutions. It takes capable and conscientious people, along with proven business processes to deliver the right set of solutions.

We enable transformation in the financial services industry through our extensive experience in providing right set of end-to-end financial solutions. Each solution runs as a scalable, robust component, fully integrated with existing business models, and enterprise and technology infrastructures. These preconfigured, customizable retail banking, corporate banking, and capital market solutions can cut the costs involved while delivering the agility you need to handle risks and serve a growing customer base.

Our Solution

We offer financial institutions an entire range of offerings to meet current challenges in the financial services industry. We help manage risk, comply with regulations, and manage transformational challenges while driving efficiency and improving service levels.

Functional Expertise

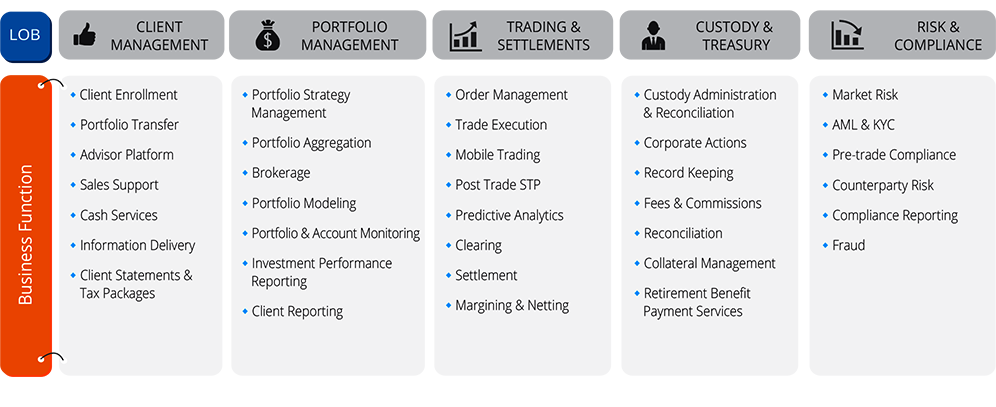

- Asset Management and Securities: Order and Trade Management, Risk Management, Mutual Funds, Hedge Fund Portfolio Accounting, Trust Accounting, Retirement Benefits, Portfolio Performance and Attribution, Custody, Corporate Actions, Compliance (AML & Post-trade)

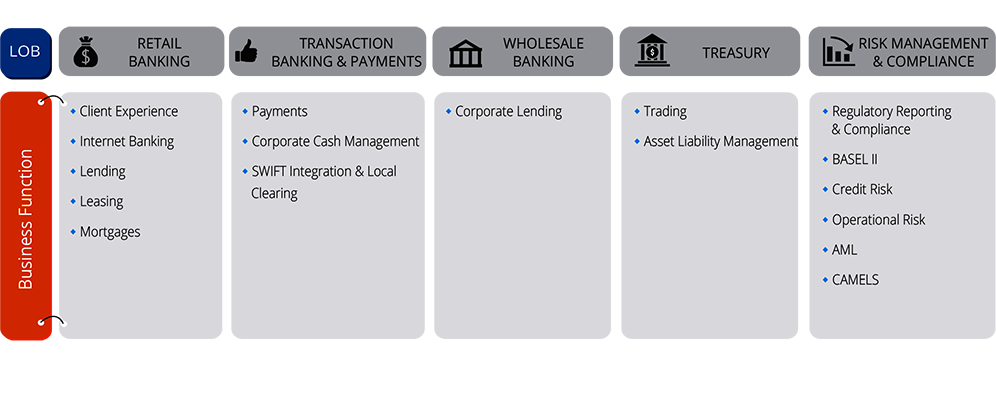

- Banking: Client Experience, Internet Banking, Lending, Leasing , Mortgages, Payments, Corporate Cash Management, SWIFT Integration & Local Clearing, Trading Asset, Liability Management, Regulatory Reporting & Compliance, Basel II, Credit Risk, Operational Risk, Anti-Money Laundering (AML), CAMELS Rating System

Industry-specific Solutions

At the heart of Coforge offering is a set of industry-specific solutions that cover processes across the entire finance value chain:

- Reference Data Management Solution

- Advisor Portal Solution

- Advisor Portal Solution

- Security Incident Monitoring Solution

- Mobility Solutions

- Regulatory and Investment Management

- Reporting Solutions

- Core Banking Solutions (BankingEasy)

- Assure Easy: A unique solution that focuses on areas such as compliance risk, technology risk, and operational risk

End-to-End Enterprise Solutions

We provide an entire spectrum of integrated IT and BPO services to the world’s leading names in the banking industry.

Some of our offerings include:

- Application Development and Management

- Application Development

- Application Management

- Application Renewal

- Migration

- Modernization

- Decommissioning

- Testing Services

- Data Warehousing and Business Intelligence

- Enterprise Solutions

- Package Implementation

- Managed Services

- Business Process Management

- Business Process Outsourcing

- Customer Support Services

- Finance & Accounting Services

- Transactional Support Services

- Sales & Marketing

End-to-End Testing Framework Capabilities

Our distinctive advantage as a provider of financial services is the ability to help companies cover various business functions.

- Structured Banking Testing Framework (BTF)

- Development of In-house Business Testing Frameworks covering:

- Internet banking/mobile banking

- Lending and mortgages

- Wholesale and retail payments

- Retail and corporate deposits

- Order management for securities

A Financial Partner with Extensive Experience

Comprehensive Experience in Servicing the Capital Markets Value Chain

Platform Experience

- Front-office: Order Management System (Treasury Point, Charles River, Longview, Calypso, and Misys), Customer Relationship Management (Salesforce)

- Middle-office: Reconciliation (Advent), Cash Management (SmartStream Transaction Lifecycle Management (TLM))

- Back-office: Wealth Management (Global Wealth Platform), Compliance (Actimize (AML), Protegent (Trading)), Reference Data Management (RDM), Investment Accounting (Trust 3000), Data Aggregators (Pershing, Albridge)

Comprehensive Experience in Servicing Retail and Corporate Banks

Platform Experience

- Misys – Equation, Midas

- DataMate

- Fermat Algorithms – Risk Management and Asset and Liability Management (ALM)

- Actimize – AML

- Lexis Nexis – KYC/Watch Lists

- Wall Street Systems

- Electronic Bill Presentment and Payment (EBPP), Automated Clearing House (ACH), and Local Wire Integration and Application for Financial Institutions

The Coforge Advantage

With more than 15 years of experience in servicing capital market firms and a substantial market share, we support more than $ 1.5 trillion Assets under Management (AUM), more than 6000 financial advisors, and service more than 1.5 million end customers. We have an established portfolio of over 200 financial institutions-10 of the top 15 US private banks, more than 100 asset managers, 15 wealth management firms, six broker dealers, and 30 pension funds-served by more than 800 resources on active projects. We also have demonstrated experience in managing complexity-more than 45 software products and more than 350 releases per year.

Uniquely positioned, Coforge has earned the Best Outsourcing Award from a leading European bank and the ICT Innovation award from a Belgian financial institution.