3 ideas towards a fast, efficient and profitable mortgage operations process. The U.S. real estate industry is in a volatile state – as much, if not more, than it was during the 2008 financial crisis. We are seeing some record numbers in decades, as far as the mortgage industry is concerned e.g. rising foreclosures, really low interest rates, shortage of inventory, etc. None of this is stable though – while at times things may seem to fall in place, the next moment something completely different occurs. Some of this can be attributed to the uncertainty and changing consumer behavior. People and organizations have accepted a new normal causing a significant change in buying behavior, especially in large investments such as buying a property. Will some people may cash in on this period due to record low interest rates, others are unsure about the future and are simply waiting and watching.

This change in consumer demand has brought about change in the suppliers to these consumers i.e. lending organizations. While the lenders are doing their best to adapt to the volatility and to cater to the evolving market needs, they must focus on long term benefits that will reap consistent profits rather than short term wins. To get a better understanding of what’s going on in the mortgage market, Fannie Mae reached out to 254 senior executives between May 5-18, 2020 - representing 229 lending institutions - to participate in the Mortgage Lender Sentiment Survey (Q2 2020 Report) published June 11, 2020. Here are some of the statistics from that report:

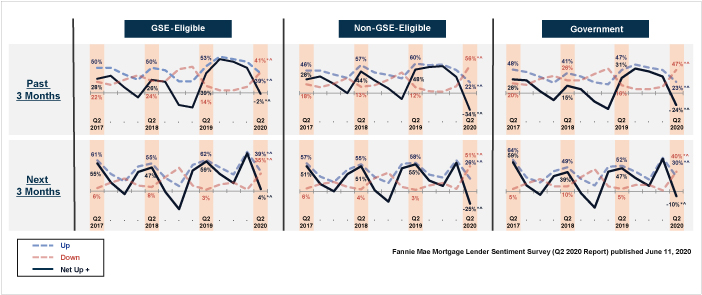

- Purchase Mortgage Demand The net share of lenders who reported demand growth for the prior three months and the next three months fell significantly from last quarter across all loan types.

Low purchase application means a decline in profits and a rise in costs. The question is what must lenders do to sustain themselves in this period? While laying off resources may be the easiest thing to do – is it the only solution? Why not look deeper into your operations, identify areas that can reduce expenses – typically identified by looking at the wastage of time, and wasted human effort. Read below to know-how.

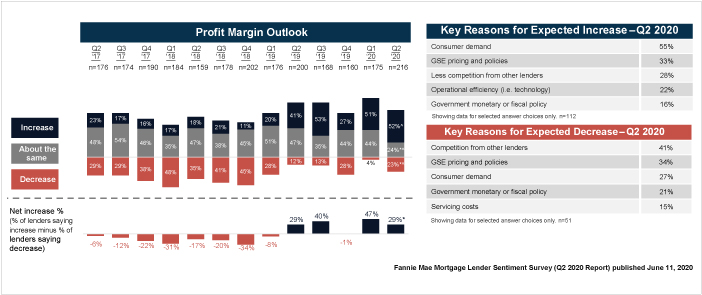

- Lenders’ Profit Margin Outlook – Next 3 Months The net profit margin outlook fell from last quarter’s survey high but remained positive and similar to the profit margin outlook in Q2 2019.

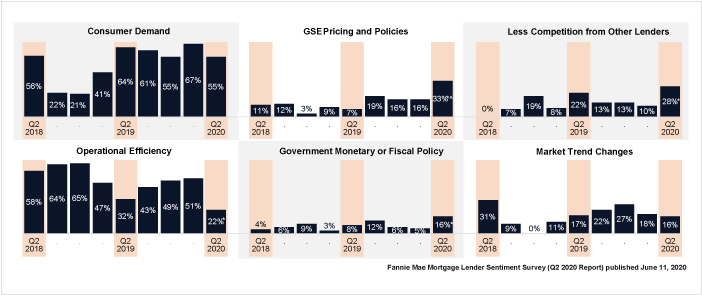

a. Increased Profit Margin Outlook – Top Drivers “Consumer demand” remained the top reason cited by lenders for their increased profitability outlook.

As the age-old saying goes – Consumer is king! A positive buying behavior can even help improve the economy significantly. As demand surges, or falls, how will lenders ensure the best borrower experience? The key is to focus on critical areas within your operations. We are all aware that quick response time and good communication are essential to ensure a delightful borrower experience. And contrary to traditional thought – huge technology investments are not always the answer to enhanced borrower experience. Intelligent technology, smart process re-engineering, and optimized utilization of manpower can help lenders elevate their customers’ experience more quickly and cost-effectively. Read below to know-how.

As the age-old saying goes – Consumer is king! A positive buying behavior can even help improve the economy significantly. As demand surges, or falls, how will lenders ensure the best borrower experience? The key is to focus on critical areas within your operations. We are all aware that quick response time and good communication are essential to ensure a delightful borrower experience. And contrary to traditional thought – huge technology investments are not always the answer to enhanced borrower experience. Intelligent technology, smart process re-engineering, and optimized utilization of manpower can help lenders elevate their customers’ experience more quickly and cost-effectively. Read below to know-how.

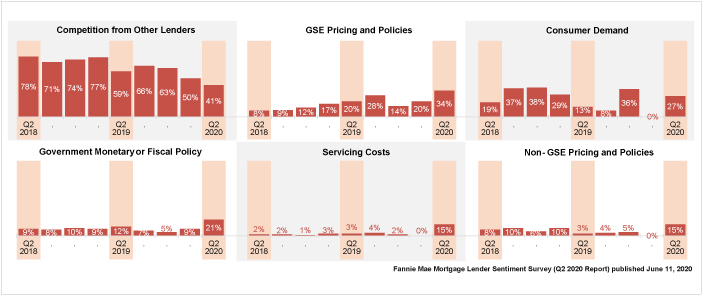

b. Decreased Profit Margin Outlook – Top Drivers “Competition from other lenders” continued to be cited by lenders as the top reason for expecting lower profit margins.

The lending industry has always been a competitive one but the need to win the race is more than ever now. The only way to win over the competition is by attracting and retaining customers. To understand this better – lenders must think about what their customers need. No blanket solution applies to all. Every lender must microscopically go through their process and identify areas that are inefficient or redundant. This means areas that are increasing turn time, affecting consumer communication, or adding costs. This may vary for each lender based on their operations. The way to a consumer’s heart is simple – be quick, be pro-active, and keep communicating. A lender who masters this does not have to worry about competition. And again, as mentioned above technology alone is not the answer to efficient processes. A combination of technology and smart process-reengineering is the key.

The road to a fast, efficient and profitable future Our experience with mortgage processes and lenders in the U.S. over decades indicates that the major part mortgage operations that typically involve wasted time and effort (and therefore increase costs) are many of the activities that lead up to the underwriting process. They include:

- Longer cycle time from application to processing

- The lag time in communication with borrowers

- Multiple file touches by processor and underwriters

- Inaccurate quality checks leading to rework and higher compliance penalties.

There could be several other reasons, but these are the ones that we have identified that are easy to identify and fix as well.

- Use technology for borrower document collection in application processing Every time a customer goes through a loan application process, the borrower is required to submit several documents that decide their eligibility. These documents are collected and checked by a processor and then the document file is moved to an underwriter for a Conditional Loan Approval (or CLA). Although this seems pretty straightforward and a one-time collection, in reality, this requires multiple rounds between the borrower and the processor to get all the appropriate documents in place, increasing the time to move forward, as well as reducing the efficiency of processing. Moreover, the processor may end up focusing on trying to wrap-up a particular loan in hand, in-turn de-prioritizing other new ones coming in, and leading to further backlog. These add to the overall cost of the entire process of taking a loan application underwriting and to final closure. The question is, can borrowers and processors be empowered with a process - supported by technology - that reduces the back-and-forth and potentially automates the process to a level to avoid these challenges? The obvious method is to use cutting-edge technology (ICR/OCR, RPA, AI, Mobile App, etc.), but that means a fair amount of investment dollars, as well as process change and learning for processors, LO’s and even the borrowers. Alternatively, a simpler low-cost, quickly implementable approach is the use of ‘algorithms’. An algorithmic checklist that not only identifies the missing documents but also informs and follows-up with processors, LO’s to ensure they have the right documents before submission to underwriting can help streamline the entire process. We have been able to implement this for Banks and independent mortgage lenders and achieved a reduction of 60% in the Loan app to Underwriting times. Although this may sound like a low-tech solution, it converts a deep understanding of the real-world process of document collection and verification, with easily implementable technologies, to reduce the time to get a file to an underwriter to as low as 24 hours. An algorithm-based checklist that checks the collected documents and makes sure underwriting requirements are as per requirements, can be a savior for banks that need to keep their technology costs low, but who still want to implement quick solutions based on technology.

- Ensure processors submit CLA ready file for underwriting, really quickly We all agree that the authority to sanction a Conditional Loan Approval is only with an underwriter. But that does not mean that the relatively more expensive resource (an underwriter) should do the unnecessary groundwork before getting to the approval part. Think about the time and cost we would be saving if the processor can submit a CLA-ready (or Conditional Loan Approval ready) file to underwriting. As easy as this may sound, the implementation of this process requires a combination of optimum services and technology backed by knowledge of the nuances of exactly what is needed to reduce the file ‘touches’ by an underwriter. Every touchpoint since the application has to be streamlined to a high degree. Usage of technology, historical data for trend analysis, algorithms, communication modules, and more will come into play to make sure that the processor can submit a CLA ready file for underwriting. There are domain experts in this specialized area who make this possible and lenders who have benefitted with cost reduction and faster closing. In our case, we have helped customers reach a stage of 1-touch underwriting and ‘loan submission to underwriting’ within 48 hours within 3 to 4 weeks of implementation.

- Use QC and QA to deliver more than just compliance

After 2008, and with the introduction of regulatory reform, lenders have introduced several Quality Control and Audit processes with the main purpose of complying with regulations. That’s because one compliance or quality check that is not carried out correctly can potentially cost millions in fees and fines. Compliance is a need not just for regulators, but the thinking of investors has changed and they also want to make sure they do not end up with portfolios with compliance issues, leading to the salability or valuation problems. As lenders, having all of this investment in place already to ensure compliance, it makes sense to utilize it for something that is becoming critical as the mortgage volumes decline – making processes efficient and reducing costs. A new breed of providers is putting into place methodologies that not only ensures better loan quality and compliance, but uses the information garnered from the QC activities at any and every stage, to build data intelligence which can directly influence sustainable process improvements – not just for the process being checked, but across the whole mortgage lifecycle. This is something we have started actively implementing and delivering for our customers now – and this is fast making QC and QA not just a cost center, but a contributor to process improvements affecting the bottom-line of the organization positively.

The conclusion

Today, mortgage loans must be done right with great scrutiny throughout the entire production process. That would typically add cost and effort to the process. On the other hand, competitive pressure, demands from borrowers, and tighter margins require lenders to engage customers, be aggressive with timelines while maintaining loan quality and keeping costs low. This is needed to be profitable and to grow. That is where lenders are using the help of experienced providers who are able to integrate technology, optimized processing services, and intelligent process analytics to drive mortgage process improvements. These optimal services, which require low investment to initiate, are eventually helping to improve the lenders’ bottom-line and get ahead of competitors in an increasingly tough mortgage environment. Contact us at CoforgeBPS@coforge.com or visit our website to know more about these and our other mortgage support services.