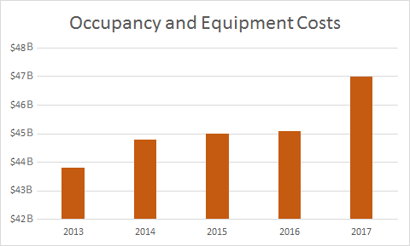

Recent statistics, as published by JLL (in a recent article in MBA Newslink), indicate that banks could be looking to save overheads of up to $800 million if they are able to let go of 20 million square feet of real estate, shift many back-office functions and choose to operate in lower cost markets. This is saying a lot since most banks are paying rising amounts in real estate and equipment costs, with the latest figure of 2017 coming to $47 billion for all U.S. banks.

As seen in the chart, occupancy and equipment costs for Banks increased dramatically from 2013 to 2017 - a 7.3% rise in this short period of time. Reducing back office, moving back office to lower cost areas, etc. is in itself not seen as something negative, and many companies have relied on it as a way to reduce costs and increase efficiency. Many banks and lenders have shifted their back-office operations to less expensive markets in an effort to increase overall profitability. And, as mentioned, estimates indicate that in the current situation, by doing this, banks can save up to $800 million in overheads and offset the pressure of slowing growth.

However, back office innovations do not stop at just reducing occupancy and real estate costs – there are many other ways to obtain sustainable benefits which have been tried and tested over the years. In this blog, we have listed the 3 key growth drivers that can improve process maturity and lead to year-on-year profitability.

1. Reduced costs with enhanced productivity

We are all aware that the business of lending is heavily dependent on manual effort. All this comes with a cost - the cost of manual effort to collect and interpret data and the cost to maintain efficiency in handling these multiple processes and systems. Moreover, manual effort makes processes vulnerable to errors. This increases the chances of document rejection, calculation errors, etc. leading to increased costs associated with rework, time lost and the need for additional human resources to fix errors. When operations move to back offices that specialize in specific processes, there can be a significant cost reduction due to this, and the ability to achieve the same output with fewer resources, or increase output with the same resources. These resources specialize in a number of skill sets and get work done quicker and faster, and most importantly, more efficiently and with fewer mistakes. The focus on quality checks, years of experience, and use of tools for error reduction and process efficiency are built into these operations. Also, let’s not forget the fact that back office innovations over the years have helped streamline and automate complex processes, reduce manual work and eliminate duplication of effort. This is an intelligent cost management strategy, which allows a business to reduce costs without adding fixed costs and hindering their growth. Research indicates cost savings in the mortgage operations, for example, ranging from 40% to 60%, and efficiency increase up to 50%, can be achieved.

2. Technology benefits that are easily accessible

With origination volumes going down and costs increasing, lenders are under immense pressure as they try to retain their profit margins. And similarly, in the banking space, it’s about engaging and retaining customers. And one way to do this is to use technology. While they may have the will to do so, their existing IT systems may not be flexible, and in fact, hinder time-to-market and increase costs. On the other hand, to keep up with competition, lenders are facing increasing pressure to introduce new technology into their processes quickly. But implementing a new technology, with its associated costs, may not be easy. In either case and even with or without technology implementation, they must continuously train employees to introduce more efficiency in processes and to use the latest technology tools. When you partner with a back office operations provider in this area, there are multiple benefits. You can get access to experts who already have a ready-to-use/ easily implementable technology or platform, and you get access to their trained resources at-hand to do this type of work. Moreover, you save a lot of time on research related to finding out the best fit technology to be implemented in your specific business environment. So it’s a win-win situation - as you are improving your quality of operations, your efficiency, and your customer experience as well as saving a lot of costs.

3. Operational agility at no additional cost

As an enterprise grows and adds more employees and operations processes, it becomes increasingly difficult to manage and coordinate among all of them. To get access to the best talent, a lot of time and money is spent on recruitment and training. However, with volatility and uncertainty in the market, there are times when the management has to cut back on resources to reduce production costs. Or suddenly increase staffing if there is an unexpected growth in any business for some reason. Frequent hiring and firing is something companies can avoid by outsourcing their back-office operations to specialists. The advantage here is obvious - enhanced ability to react to changes in the business environment. They will have the flexibility to deploy already trained employees as and when they require. These resources are industry experts who have the extensive knowledge about processes and can easily adapt to ensure compliance with shifting market and regulatory objectives. Most back office operation is based in lower cost geographies so labor is cheap and many of them run around-the-clock. By running 24/7 they are able to cater to the needs of each and every client and provide solutions to problems at any hour. And if the provider offers pay-as-you-go pricing, you have the immense flexibility to save when volumes or business declines, and spend more only when your business is growing.

Coforge is one such firm, and it has been specializing in business process management for the past 17 years. With more than 100+ clients in the banking and mortgage services area, including 4 of the Top 25 U.S. banks, they deliver comprehensive products and solutions driven by technology for the mortgage, title insurance, banking, cards & payments, and lender placed insurance , Property & casualty insurance industry. Their team of 3,000+ experienced professionals operates out of multiple global locations including the U.S. and can help bring back-office innovations to your firm, therefore reducing your costs, increasing productivity, and improving operational flexibility. For more information visit, https://www.coforge.com/bps/. You can also write to us at CoforgeBPS@coforge.com.