Tackling natural disasters, Large combined ratios, Changing technologies

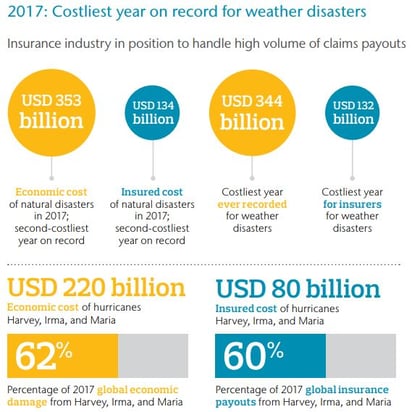

The year 2017 recorded the highest ever global economic losses arising from natural disasters, according to the AON Benfield report titled ‘Weather, Climate & Catastrophe Insight: 2017 Annual Report.’ The report goes on to say that three major hurricane events in U.S. - Harvey, Irma, and Maria - cost the insurance industry USD 80 billion, corresponding to 60 percent of all losses from 2017.

Source: Weather, Climate & Catastrophe Insight, 2017 Annual Report

2017 was one the most challenging years for the U.S. property and casualty insurance industry too, characterized by significant pressure on operating results, largely due to record catastrophe losses and softer markets.

After a difficult 2017, U.S. P&C Insurers witnessed a rebound in profitability in 2018, primarily driven by interest rate hikes, sustained economic growth, and lower catastrophe losses. The 2018 combined ratio for the industry was projected to improve to 99 % from 104% in 2017. However, the current environment of economic uncertainty, as well as the changing dynamism of the industry, makes it difficult to predict if the growth momentum witnessed in 2018 will continue into 2019 and the year ahead.

In our opinion, the P&C Insurance industry is witnessing a major revolution and to sustain profitability in this dynamic environment, insurers will need to focus on some key factors:

- Improving operational efficiency and optimizing costs through business transformation initiatives

- Providing an omnichannel experience to engage customers and serve their needs

- Staying ahead of the competition, and disruptive players, through product innovation

- Improving underwriting efficiency to reduce operating cost

- Technology overhaul to catch up with advances in deployable technologies

Key strategies being adopted by insurers to sustain profitability

We have seen some key strategies being widely adopted to improve profitability - especially automation and transformation of the customer journey through digitalization. Increased investment in disruptive technologies like analytics, Robotic Process Automation, and Artificial Intelligence are being used increasingly to significantly speed up and simplify even complex processes like claims resolution.

Technology transformation involving legacy system overhaul, though being considered, may not be feasible in these challenging times for most insurance carriers due to the high upfront capital cost associated with this activity.

Among the several strategies being considered, what we have observed is that insurance carriers are now considering a more holistic view of operations/ business transformation with a focus on gaining improved business agility, scalability, quality of operations and straight-through processing. To help them in their transformation journey, most insurance carriers have partnered with third party service providers who can help them with their offerings of processing services coupled with an automation play. This unique combination is being utilized by medium and large insurance players.

Outsourcing as a viable alternative to sustain profitability

Research reports by analyst firms like Everest Research indicate that the P&C Insurance back office process outsourcing market has been growing consistently at 13% from 2015 - 2017 and is expected to continue growing. Transactional processes and also judgment intensive tasks like underwriting, claims adjustments, analytics, etc. have been commonly outsourced. We are seeing more outsourcing contracts being now executed around business/ operations transformation, as insurers are seeking comprehensive solutions to help them transform their existing operations rather than focus on improving the efficiency of a single process or subprocess.

In addition, each business transformation relationship assures value beyond the typical labor arbitrage benefits. Additional value benefits like the higher quality of processes, improved efficiency and straight through processing, enhanced customer satisfaction and improved risk management are some of the additional gains from these holistic outsourcing partnerships.

What do buyers typically look for while selecting vendor partners?

Generally, insurance carriers are partnering with large to mid-size vendors who have expertise in managing complex financial service processes, along with experience in low-intervention technology implementation. In addition, these vendors should have capabilities to enhance process efficiencies with technology-enabled RPA, AI, and analytics-based solutions in order to drive greater automation and bring in greater efficiency gains.

With over 18+ years of experience and serving over 100+ customers, Coforge BPS is one such vendor with experience in supporting complex financial service processes with technology-enabled solutions. See our wide experience and solutions at https://www.coforge.com/bps and contact us today at CoforgeBPS@coforge.com