The Insurance business has always been seen as a steady legacy business – but is that really true now? Insurers are currently dealing with multiple challenges including the pressure to sustain growth, to stay competitive and reduce customer churn. And many insurance businesses are facing a ‘survival of the fittest’ scenario – and need flexible and agile operations to accommodate the ever-changing customer demands, adapt quickly to unforeseen circumstances and manage scalability requirements.

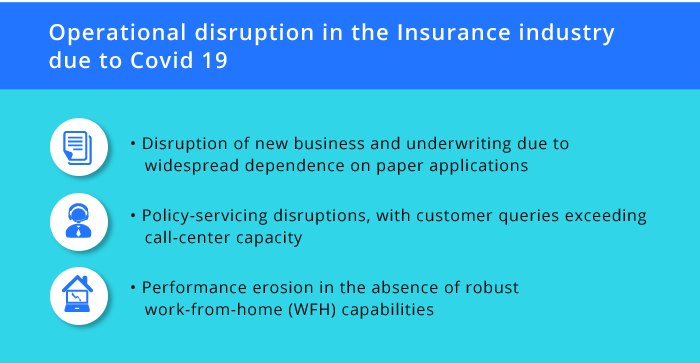

The ongoing pandemic has proved how insurers that had flexible and agile operations, could easily adapt to the remote working model and continue with their core business operations with minimal disruption. They may have even managed unforeseen business demands - like the sudden increase in volume of queries, like in call centers and email communication.

Source: McKinsey & Company: Insurance resilience in a rapidly changing coronavirus world (April 2020)

So how do Insurers achieve business agility and flexibility? Here are some ways:

1.) Digital Transformation: With customers demanding speed, simplicity and seamless methods of interaction, insurers are rethinking their business models. They are joining the digital highway.

Digital transformation involves using digital platforms to improve business operations. It also includes the usage of technology-enabled products and solutions like analytics and intelligent automation to achieve customer centricity and to enhance business outcomes.

However, digital transformation is a concerted and continuous journey that needs to be thoughtfully planned and executed in a well-defined phased manner to achieve all the positive desired outcomes.

And inflexible legacy systems can pose a challenge in the digital journey. We have seen instances where insurers try to add new digital technology on to an existing legacy system and end up not achieving the agility and flexibility that may be typically achieved through efficient digital transformation. Unfortunately, replacing legacy systems can be an expensive, time consuming and complicated process.

2.) Outsourcing – To get the benefit of additional operational flexibility & agility, insurers can partner with third party outsourcing service providers for back-office processing support. These outsourcing providers offer customized solutions based on business needs and have the operational agility to adapt quickly to any changes in business. In addition, many of these outsourcing partners evolve to become strategic partners who help their customers transform existing business operations by identifying non-value adds in their operations and leverage the right combination of automation and services to help achieve higher operational flexibility. Not just that, with any market volatility, they can easily scale up or down based on the customer needs. These outsourcing providers are equipped with strong business continuity management plans that enables them to support customer operations without disruption even in unforeseen circumstances. For example, in the current Covid situation, these firms have been able to support not only existing business from existing customers but have been able to scale up to meet the needs of new customers.

Coforge is one such third party outsourcing provider which has been serving the financial services for over 20 years. With its suite of digital platforms and business process solutions, it has helped clients optimize existing business operations and achieve operational flexibility and scalability. In addition, with its ability to onboard new customer business quickly – in a few days to a few weeks, Coforgehas been one of the few outsourcing vendors successful in supporting business operations without any business disruption for both its existing and new customers, even in the current Covid pandemic circumstance. If you need any help, especially in terms of flexibility or scalability in your existing insurance operations, please email us at CoforgeBPS@coforge.com or read more about our capabilities here