The P&C Insurance industry is witnessing a revolution driven by changing customer needs and disruption led by new technologies. To keep up with the pace of the transformation in the P&C insurance industry, P&C insurers have now increased their investments in emerging technologies or insurtech capabilities.

As per a recent Capgemini report “Top 10 Trends in Property & Casualty Insurance 2018: What You Need to Know”, the top technology trends included the use of the latest technology and innovations, including Artificial Intelligence, Robotics Process Automation, Drones, Blockchain, Internet of Things and autonomously driven vehicles. Included also, was the fact that an increasing number of P&C Insurers are now embracing analytics for use in their business.

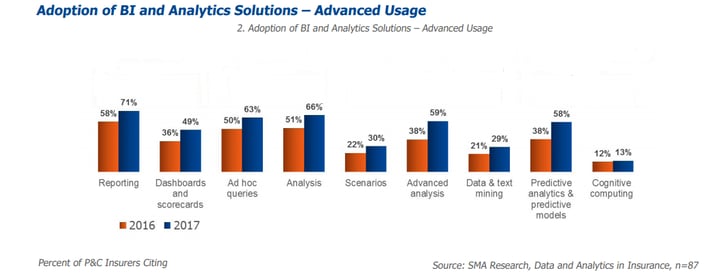

Apart from direct cutting-edge technology usage, which is still maturing, one key theme of change revolves around using technology and automation to collect large amounts of data, analyzing the data, and then using that data to improve processes and drive better decisions.

(Source: Data and Analytics in Insurance: P&C View through 2020 - SMA Research Report, July 2017)

(Source: Data and Analytics in Insurance: P&C View through 2020 - SMA Research Report, July 2017)

One area that is expected to benefit immensely from analytics is obviously underwriting that involves analyzing external and internal information to gain deep insights into individual and group profiles, and to tailor the insurance according to the risk profile and risk appetite of customers. This should also help develop underwriting strategies and new businesses.

Analytics can also be leveraged to improve the operational efficiency of an insurer’s operations by collecting and analyzing the data across the value chain, including application processing, underwriting, claims processing, policy administration, collections, etc.,. So could RPA and automation in general.

What we have seen is that Property & Casualty insurers are eager to embrace technology and change – but the problem lies in two specific areas. Firstly finding a vendor or vendors who can support them in multiple areas – data management, RPA, process optimization, performance analysis, and analytics. There are specialists in each of these areas – but this means the insurer ends up coordinating the work of multiple vendors.

Conversely, there are one-stop-shop vendors as well – but these tend to be high-priced consultants, who often define what to do, but may not be interested in, or unable to complete, the implementation themselves or be cost-prohibitive.

And secondly, these large vendors always come at a very high cost to consult, design and implement any solution, to deliver the projected benefits spread over multiple years – always a plan that any cost-conscious operational leader, and certainly CFOs, have a hard time accepting.

On the other hand, we are seeing a new breed of agile vendors who are not high-end experts in these technologies or even in the insurance domain – but come with strong process and technology implementation skills, possibly in other industry verticals, but who have a framework that allows for a model of immediate efficiency improvement and cost reduction (using lower cost manual processes, and technology solutions that work with legacy applications), with a simple roadmap to implementation of more innovative technologies and solutions that replace the temporary solutions.

For a lot of vendors, this is hard to achieve. Why? Because this means the use of manual labor to start with, and then cannibalization of the manual processes with automation and innovation. It also requires experience with more complex operations than the P&C business, but with similarity to them. A great example of this is expertise in mortgage processes - mortgage underwriting (far more complex, but very similar to underwriting in P&C insurance), mortgage 30 and 60-day collections (like delinquency and payment calls in P&C Insurance), and even cards and payments dispute processing (like the Insurance First Notice of Loss).

To summarize it all, in the current environment of industry disruption, complete systems, and process overhaul is not the only optimal solution to stay competitive. A much easier and optimal path to take would be to partner with a vendor with complex financial services experience, knowledge of the process and low-intervention technology implementation, and with an ability to implement lower costs and more efficient process solutions to start with, but with a roadmap and view to replacing the process solutions with technology enabled RPA, AI and analytics-based solution in the short to medium term.

Coforge BPS is one of this new breed of agile vendors with experience in complex financial service processes, with technology-enabled solutions, and the ability to deliver in the immediate term, with a view to longer-term solutions. See our wide experience and solutions at https://www.coforge.com/bps/ and contact us today at

CoforgeBPS@coforge.com.