The banking, financial services, and insurance (BFSI) industries are some of the most paper-intensive industries globally. Paper still continues to dominate several areas of these industries even though tremendous progress has been made in digitization and automation.

Being a highly regulated industry, financial institutions are subject to compliance scrutiny, audits and required to maintain an audit trail. Any incorrect information or failure to retrieve and produce information during audits can lead to penalties and fines. This drives the need for an efficient and secure method of understanding, classifying, storing and archiving documents and easy retrieval when needed.

Directly storing physical paper documents is cumbersome and costly for financial institutions. But processing a large amount of information, from the millions of documents collected, and its further conversion to a digital format for business operations is a tedious task. Without automation, this involves setting up teams of dedicated back-office resources to support the manual indexing and extraction of information from these documents into the relevant operational systems that run the respective businesses.

Over the past few years, financial institutions have invested in Document Management solutions or have partnered with firms providing document management services to convert their paper-based information into digital format. These Document Management solutions have Optical Character Recognition (OCR) and intelligent character recognition (ICR) technologies that help not just in identifying the text from scanned paper documents and capture the data into the relevant fields on the business system for further business processing, but also help in classifying these documents, as well as retrieval from archives in the future.

Are OCR technologies foolproof?

Most OCR technologies have high accuracy levels while digitizing ‘structured’ documents – i.e. documents are standardized ‘forms’ or recognizable formats. Exceptions do arise in cases where the information may not be legible and interpretable and hence may need manual intervention.

In the recent years, OCR technologies have evolved in their accuracy to digitize not just structured, but also unstructured documents, with features like Natural Language Processing (NLP) that have become a key component of most OCR tools. NLP along with a rules-based approach or advanced machine learning capabilities makes the solution more powerful and accurate.

How do Financial Firms benefit from Document Management Solutions?

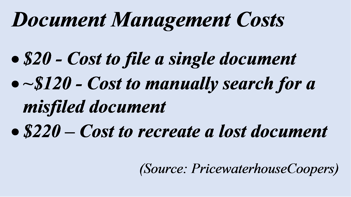

- Cost Reduction in Document Processing - Helps reduce manual processing significantly and reduce fixed costs

- Faster Retrieval of Documents – Enables easy document search and retrieval of information, when needed

- Reduced Errors - Helps reduce errors in data entry and subsequent rework and/or errors with a financial impact

- Enables quicker business processing and helps improve customer satisfaction

Several financial institutions have integrated document management solutions into their core operating systems, thus enabling data digitization and further processing at a lower cost, and with greater speed and accuracy. But even with these solutions, exceptions or data fail recognition is manually entered into the systems by a team of back office professionals.

However, these solutions are expensive and time-consuming, and not all firms can afford to implement these. Hence one easy option may be to outsource the complete document management of processing services to third-party service providers. These providers leverage advanced technology solutions and combine it with human effort, to take care of digitizing 100% of all documents at lower costs and greater accuracy.

Coforge is one such third party provider with over 20+ years of experience in data processing and indexing, and has helped its financial services customers including Banking, Cards and Payments, Mortgage, Lender Placed Insurance Firms and Title Insurance firms achieve above 40% cost savings, 15% to 20% turn time improvements and above 98% accuracy in their document processing needs.